Rugby Finances

-

Inside that telegraph link, were these extras:

AT A GLANCE

Club-by-club | What financial shape is your side in?

By Ben ColesBath

Not a lot of serious red flags, albeit the level of debt has increased to an unsustainable level, which is mostly shareholder loans. The problem with Bath is that its operating structure will require continual propping up by Bruce Craig.Bristol

Bristol are OK as along as Steve Lansdown keeps on funding the club. He has a big cheque book but is happy to fund a business that has lost £30m over the past five years at the EBITDA (earnings before interest, taxes, depreciation, and amortisation) line. That is a passion.Exeter

Exeter have been much better at running its business than more or less all of the clubs. They have taken on more borrowings in Financial Year 21, but they have managed their business with a lot more vigilance.Gloucester

Gloucester would be on the fringe, but are not over-invested in hard assets, around £8.6m. They have a little bit of debt, bearing in mind some of that is the Covid loans from the Government, and were sensible to take that on.Harlequins

One club that is concerning is Harlequins. They borrowed £48m in FY21, maybe through £50m on the back of FY22. If you look at operating profit per employee, they are paying £60,000 per employee and going backwards. It's the structure of the business – big property investments, borrowings.Leicester Tigers

Their turnover averages £19-20m and they still incur losses, although they were more or less breaking even prior to Covid. Their latest net debt to revenue for FY21, with the debt being 0.8x their revenue, was their worst in the past six years but one of the league's best returns.London Irish

London Irish are challenged. They have never made a profit, have £30m worth of borrowings. It’s one club that’s potentially at high risk because of very low turnovers, at best in a good season of £10m.Newcastle Falcons

Another case of an unsustainable operating model, although in recent years have improved significantly. Club is also being propped up by a major shareholder increasing the loan over time. Too much debt for too little revenue.Northampton Saints

Probably managing better than most. Relatively low debt levels. Also seemed to manage the impact of Covid better than other clubs, reducing costs and managing to minimise the operational loss.Sale Sharks

Sale just run a club, they do not have any property. Their only problem is their operating costs are pretty chunky, which is why they could potentially be under pressure. They had the reprieve with the CVC payout, but ultimately it’s an unsustainable model.Saracens

Continued to incur significant losses of £30m over the last six years (up to FY21). Debt waived of £42m in FY18, resulting in nil debt for that year. However by the end of FY21 the net debt had leaped back to around £25m. While costs have declined, revenue was halved in FY21.and a graphic:

-

@Rapido Doesn't read well does it?

Funny thing is that on very simple terms that report is saying that free market capitalism doesn't work well in sporting comps and that a hefty degree of socialism is required. Trouble is that the backers/owners of the clubs are pretty much people that free market capitalism has served well in the past.

I'm glad that NZ went down the central contracting route from the start. It isn't always plain sailing but we also don't have the prospect of say a Hurricanes franchise crashing and burning off the field. It has also allowed the survival of the feeder tier of NPC despite that having even bigger challenges. If NPC teams were privately owned we would probably see teams like Ta$man in serious strife like they have been before.

I hope they sort it out because the global season also depends on NH clubs being on board and being able to look further than the bank manager.

-

@NTA said in Rugby Finances:

Oh sure the clubs are in financial trouble, but look at it this way:

"Now is the right time for more money"

-

@NTA said in Rugby Finances:

Oh sure the clubs are in financial trouble, but look at it this way:

Good luck to him, but nowhere on God's Green Earth is Finn Russell worth £1m

-

@MiketheSnow said in Rugby Finances:

@NTA said in Rugby Finances:

Oh sure the clubs are in financial trouble, but look at it this way:

Good luck to him, but nowhere on God's Green Earth is Finn Russell worth £1m

Which is the point I guess. These clubs are fucking mental

-

@MiketheSnow said in Rugby Finances:

@NTA said in Rugby Finances:

Oh sure the clubs are in financial trouble, but look at it this way:

Good luck to him, but nowhere on God's Green Earth is Finn Russell worth £1m

You’re not fucken wrong.

A couple of mill at the very least.

The guy is Rugby Jesus, you’d better recognise ! It makes absolutely no sense that a guy who is somehow simultaneously too skinny and too chubby to make it as a pro Rugby player is in this position yet here we are ( seriously, the only rig worse than his would be Andy Goode )

-

@Dan54 said in Rugby Finances:

Boy I get no joy out of seeing these clubs struggling, for whatever reason. London Irish going would be a shame.

They are being wound up by HMRC because of unpaid tax.

-

Entirely fair

-

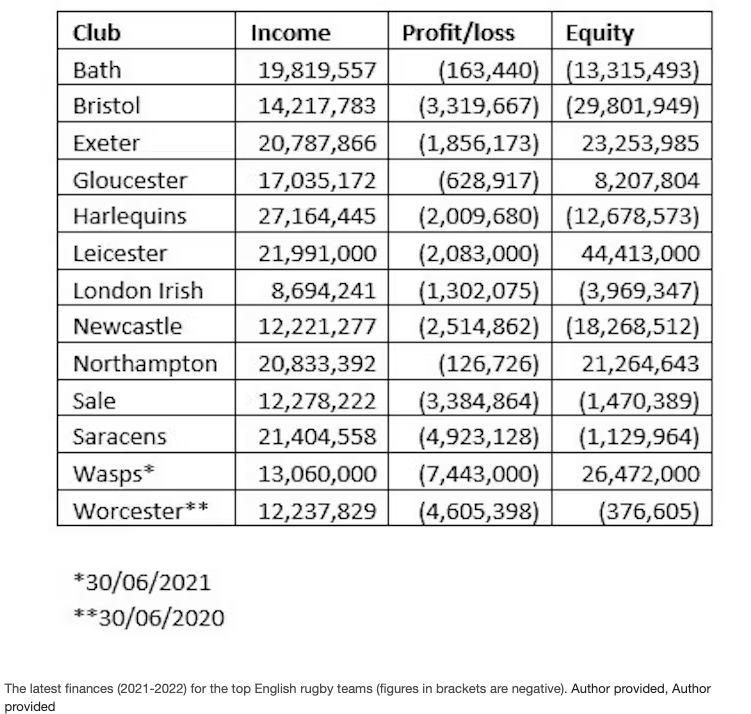

Another article on the PRL finances. Nothing new here ,except the table which includes an equity column. Which are the authors own figures.

Interesting to see the position of the clubs, by these metrics, that have fallen over - compared to the others.

Wasps collapsed because of the bond/lending markets freezing. Not because they had no equity. Although they were only a a few years from being in that position. Worcester were by no means in the worst position but had dodgy and uncommitted ownership.

Newcastle won't be around long, their owner isn't rich enough. As opposed to Bath, Bristol, Saracens for whom reality doesn't matter until they have no teams to play against.

Screenshot 2023-06-21 at 9.19.11 AM

-

@Nepia said in Rugby Finances:

TBH, English club rugby has lasted longer than I thought it would before imploding. When they first switched to professionalism I thought they'd go belly up in a few years.

Yes, it seems its been coming since the millenium. But a lot of thing in economics have defied norms for most of this millenium, so far.

I remember back in the very first year or so of professionalism. And rugby was still un-physical enough to allow mid-week matches. And was seeing some news clips of the first European cup, midweek floodlt matches, Martin Offiah etc on a temporary contract from league, playing for Quins IIRC. The future seemed their oyster then.

TO be fair to English clubs. Them (and the Scottish) started from the furtherest back at the dawn fo professionalism. Famous clubs like Wasps, Saracens, Irish, Scottish, Richmond, Rosslyn Park etc were litterally playing on suburban fields with only a clubhouse. Only Leicester and maybe Gloucester had any infrastructure to talk about.

Un-famous at the time, but big since, clubs like Worcester, Exeter, Newcastle have also started back in 1996 as suburban fields. To their credit they have built admirable infrastructure.

Just a shame they started day dot in player-salary la-la-land, and never fixed it. I remember Canterbury reserve (not Crusaders reserve, NPC reserve) Jamie Connolly (IIRC his name ...) moving from Canterbury to Harlequins in year 1 of professionalism for the same salaries that NZ Super 12 players were getting. E.g. NZ players 3 levels above his abilities. Famous 'Quins with their amateur connections to 'the city' playing triple the going rate from day dot, they were just a bit dumb.

-

Premiership Rugby clubs post losses of almost £25m for 2022-23 season

Saracens posted biggest losses of over £5 million, while Newcastle Falcons have not yet made their finances for 2022-23 period publicBen Coles,

RUGBY REPORTER

29 March 2024 • 1:17pm55

Nine of 10 Gallagher Premiership clubs have posted financial losses which total almost £25 million for the 2022-23 season.

Newcastle Falcons have yet to publicly post their results for the last financial year but of the data available, nine clubs cumulatively made a loss of around £23.5 million.

Saracens posted the biggest loss at £5,295,310, with the club’s turnover of £23,206,354 falling well short of their £28,559,147 budget.

Bristol Bears, backed by the billionaire Steve Lansdown, finished with a total loss of £4,554,814. Harlequins posted the highest turnover, £26,813,85, but had the largest budget at £30,392,791, resulting in a loss of £3,648.893.

Advertisement

Gloucester produced the best results due to having a budget of £18,291,675, which was marginally higher than the club’s turnover of £18,162,660, making an eventual loss of £393,079. Two other clubs produced losses which were below the half a million figure, with Sale making a £439,294 loss and Northampton a £467,836 loss.

Sale notably had the lowest turnover, £11,735,339, but also the lowest budget of £16,496,292. They were also one of only two clubs, along with fellow Premiership finalists Saracens, to produce a positive net financing costs figure of £258,953.

The results also disclose the number of people employed by each club, with Exeter recording the highest figure of 354 of which 156 were coaches and players. Bristol employed the fewest number of people (155) and number of players and staff (87).

Advertisement

Exeter’s financial results, with a loss of £3,994,469, included the hotel built on site at Sandy Park, which made a loss of £2m over the course of the financial year. The hotel has since been sold off, with Exeter’s chairman and chief executive, Tony Rowe, buying an undisclosed stake in the Sandy Park Hotel back in December 2022 to help pay off the club’s Covid-19 loans.

Exeter said at the time: “The fee paid for the shares by Mr Rowe not only provides an injection of capital to keep cashflow going, but will also help service substantial debts accrued by Exeter Rugby Club due to the impact of the Covid pandemic in 2020. Directors will use “their best endeavours” to retain “at least” 26 per cent shareholding in the hotel company.”

Premiership Rugby has been contacted for comment.

Advertisement

Analysis: Rugby still feeling Covid after effects

Perhaps the main factor to consider when analysing the latest accounts for the nine Premiership clubs, with Newcastle still to come, is that teams across the league are still feeling the financial effects of the pandemic, hit hard by that loss of matchday revenue.Seeing that amount of red on a spreadsheet naturally leads to concern but among the numbers there are some positives, such as Northampton posting a record turnover of nearly £22 million, up by a million on the previous year. Even a club in as strong a position as Northampton is still going to be confronted with costs, with their cash balance dropping due to the construction of the club’s new High Performance Centre.

The Premiership is still reeling from the loss of Worcester Warriors, Wasps and London Irish during the previous season and, predominantly, clubs appear to be cautious. Take Sale’s budget, around £16.5 million, being almost half of that of Harlequins (£30.4 million).

Advertisement

The same long-term concerns remain. Certain clubs relying on the large investment of owners with deep pockets, a TV deal which lags far behind the money paid for the rights to the Top 14 in France, the fact that clubs with excellent attendance figures and large capacities – Leicester, Northampton, Gloucester – are occasionally falling short of making a profit. Not forgetting that the salary cap ceiling is set to rise next season from £5 million to £6.4 million – the timing of which seems highly questionable – or how the Covid-19 loans from the government will be repaid.

These are all existing issues which require long-term solutions but right now, the aim across the Premiership appears to be to create stability.

At the same time, sources close to the league are optimistic about an increase in supporter numbers this season at matches, with gate numbers continuing to climb and up by around five per cent on the previous season. The more people back in grounds, the more revenue. Right now, every extra pound feels important.

-

With the SRU having recorded an annual loss of £10.5 million in its most recent accounts, McGuigan acknowledged that an even bigger deficit is likely next time, but believes the organisation can be back in the black by 2026.

He insists it is credible to envisage increasing annual turnover from below £70 million to over £100 million in this period, but did express bemusement at how quickly the union has frittered away two vast chunks of investment from CVC, the private equity firm, as well as a £15 million grant from the Scottish Government during Covid times.

“There are things you can point to. The women’s game is pretty expensive, you’ve got a significant investment in the pro teams. If other people are on £5 million and ours are on £8 million, that’s significant. There has been an uplift in player salaries, so you can start to understand where some of the money has gone.

“That’s OK as long as you’ve got a line of sight towards a future revenue stream that gives you extra confidence about the extra money you’re deploying into things which are effectively day-to-day running costs — not strategic investments. Confidence that you’ve found a revenue stream that allows that to continue for the long term.

“That’s the piece that’s missing in the jigsaw puzzle. How do we get to a place where the revenue stream offsets the fact we will no longer have these opportunities through CVC and government grants? That’s the piece we’ve got to fix, that’s the piece that’s very urgent and why we are sitting with losses every year.

“We’ve been running a business hot in terms of costs, with an underlying revenue stream that doesn’t support that level of costs.”

Professional men’s rugby has major financial issues which need to be tackled

Professional men’s rugby has major financial issues which need to be tackled