Rugby Finances

-

https://www.bbc.com/sport/rugby-union/63874443

Who is owed the most money?

The administrators' reports have highlighted the full extent of the CBS Arena's and Wasps' debts.

Taxpayers took the biggest hit as a result of the £14.1m unsecured Covid Sport Survival Package (SSP) loan from the Department for Digital, Culture, Media and Sport (DCMS), administered by Sport England.

A further £7m owed to His Majesty's Revenue & Customs (HMRC) has not been repaid - and there were also losses for local taxpayers.

Coventry City Council was owed more than £270,000, with the council telling the BBC the bulk of it (£228,152) was as a result of unpaid business rates.

Warwickshire County Council was owed £600 and Stratford District Council £2,868, while West Midlands Police lost £20,570 and West Midlands Ambulance Service took a loss of £1,755.

The reports also show former Wasps owner Derek Richardson had loans of about £16.5m in the various Wasps companies when they went bust.

It is a bigger blow to the public purse than when Worcester Warriors collapsed in October, owing the government £16.1m from their SSP loan (the biggest of the combined £124m package of loans given to all 13 Premiership clubs), as well as £2.1m in unpaid taxes to HMRC.

The other big losers were Wasps bondholders, who were owed £35.2m.

They did receive around £7.4m back, but it still results in total losses of £27.8m.

-

From Telegraph.

Exclusive: Premiership clubs ‘heading for disaster’ having amassed £300m in net debt

A joint investigation between Telegraph Sport and a rugby finance expert can reveal a number of clubs are financially under threat.Gallagher Premiership clubs are at risk of “heading for disaster”, having collectively amassed £300 million in net debt over the past six years, Telegraph Sport can disclose.

The figure, which excludes investment in the competition from CVC Capital Partners in 2018, highlights the fact that after Worcester Warriors and Wasps were placed into administration, other clubs are under threat.

An investigation shared by Mike Ryan, a private equities director who has produced reports on the finances of Rugby Australia and New Zealand Rugby, shows that:

CVC, which bought a minority shareholding of 27 per cent of the Premiership for £200 million four years ago, took out a £27.5 million dividend across the previous two financial years from the league’s holding company, Premier Rugby Limited, with PRL’s net debt now £29 million, having been nil before the takeover.

London Irish are considered “high risk” due to low turnover of, at best, £10 million, while Harlequins are “concerning” due to their high borrowing of £48 million in the 2021 financial year. Wasps borrowed £62 million before the end of the 2021 financial year, months before the club were placed into administration

Worcester Warriors wrote off £30 million of borrowings prior to going into administration

Sharing detailed analysis of both the clubs’ and PRL’s financial figures dating back to the start of the financial year in 2016, Ryan believes that the structure of finances and player payments must be addressed as a priority for the league’s long-term financial health.

“The club structure has historically been on an unsustainable footing. It has never made a profit. The combined losses for the clubs over the last six years, excluding the payment from CVC, has been £300 million,” Ryan explained.

“At the moment, this is heading for disaster. I would like to see the fiscal-year 2022 numbers to be more comfortable with the call, but I would be surprised if they were any better than FY19 [financial year 2019]. The overall competition is still losing money.

“It is professional on the field and semi-professional at best off the field. That is the biggest problem that rugby is facing globally, in my view.”

Addressing how to fix the Premiership’s loss-making model, with clubs in the red for earnings before interest, taxes, depreciation and amortisation, Ryan believes the Premiership must hire an independent commissioner and follow the kind of centralised model used in other sports, including American football’s NFL. That would lead to centralised contracts in the league that would ensure stricter player payments as well as “consistent accounting so at any point in time you can look at the health of the entire PRL”.

The impact of CVC’s investment has also been raised as a concern, given that PRL now holds net debt where previously there was none and has incurred £72 million of net losses since CVC’s investment, having previously broken even.

Why Premiership rugby clubs are in a financial mess

While it has been obvious to anyone this season with the demise of Wasps and Worcester Warriors that rugby's finances are under immense strain, the scale of the challenge which all Gallagher Premiership clubs are facing has not always been clear.The nine-figure amount of net debt across the Premiership without CVC's investment, £300 million, can be accounted for partly down to government loans, with £100 million of the debt owed to the Government as part of the Winter Survival package which helped Premiership clubs emerge the other side of the pandemic.

A substantial majority of the remaining debt is made up of investor debt at individual clubs, money owed to a majority shareholder which has amassed over a number of years. Debt which, in reality, it is hard to see ever being repaid. The question with those clubs therefore becomes what happens if a major investor decides they no longer want to pump millions into keeping a club afloat.

Mike Ryan, a private equities director who has previously produces reports on the finances of Rugby Australia and New Zealand Rugby, believes that the time has come to reassess the entire financial model of the league, adding that a structure similar to the NFL where the league negotiates national merchandise, licensing, and TV contracts before dividing shares equally among its teams, would be more successful with teams united and drawing from a central pot.

“The club structure has historically been on an unsustainable footing. It has never made a profit,” Ryan notes. “If you look at the successful codes, whether it’s the NFL or otherwise, they almost take a dictatorial approach. Not everyone is comfortable with it, but it makes the clubs and code successful to have a centralised approach to it, because it cannot work otherwise.

“I would be very strict on player payments, but also on the rigour and integrity of how the clubs are run. I’d have centralised contracts for all players. I’d move to centralised funding for broadcasting and sponsorship, and consistent accounting so at any point in time you can look at the health of the entire PRL.”

Certain clubs, it should be stressed, continue to perform well financially in trying circumstances. Exeter are one, even with the recent construction of a new stand. Gloucester have posted a small profit over the past two years and hope to do so again. Northampton in the last financial year recorded their highest-ever revenue.

But while CVC's investment was essential four years ago, the rub is that teams now still have to pay 100 per cent of their cost base while collectively missing out on 27 per cent of revenue which goes to CVC, at a time when every pound is desperately needed. Withdrawing a £27 million dividend is CVC's right given their substantial £200 million input, and they have been described as a very supportive and engaged partner. But how the clubs would love to now hold on to that revenue. “All of them fell into a false sense of security when they received the CVC payment,” believes Ryan.

Wasps and Worcester can be regarded as unique cases given their respective previous ownerships, but their collapses are still harrowing. Wasps borrowed a staggering £62 million in the last financial year.

Ryan adds: “It’s an unsustainable model. You cannot run a business which is turning over £20 million, £30 million and running up debts of twice that amount. A bank shouldn’t allow them to borrow against that.

“It was a hotel, events coordinator, entertainment business and stadium which tacked on a rugby club. Multiple businesses being operated by people who were essentially rugby players, when you look at the boards, highly inexperienced and with a single individual with Derek Richardson providing funding. Not the sort of board you need to be running multiple businesses, you need the right skill-sets.

“It’s got nothing to do with the players, it is mismanagement of the businesses. Auditors should have highlighted concerns earlier than they did. There was a negative profit pre-tax of £23 million between 2016 and 2018.”

Worcester's issue feels more common outside of clubs with consistent supporter bases – the amount of money borrowed could never be matched by the club's turnover.

“Worcester never made a dime,” notes Ryan. “The club only turned over £12 million. They have property, but look at the borrowings. They wrote off £30 million of borrowings and converted a portion of it to equity. The business was never going to survive with that debt. It doesn’t matter how much debt you forgive, at an operational level you’re not able to break even before paying your interest.”

Is rugby in England prepared for a radical rethink about its finances at the top of the game? Or will Worcester and Wasps be followed by others? London Irish's low turnover is a concern but the overall net debt figure for the entire Premiership deserves to be recognised and mulled over by supporters as well as those at board level.

All of the figures listed in this article have been compiled from the financial results made publicly available on Companies House. Premiership Rugby and all of the 11 Gallagher Premiership clubs have been contacted for comment. Premiership Rugby, Bath, Bristol, Harlequins, Leicester, London Irish, Newcastle, Sale and Saracens declined to comment.

The net losses of £72 million in Premier Rugby Limited are related to accounting for CVC's purchase over the years, Telegraph Sport understands, with the league's revenue for the financial year ending in June 2021 being £62 million. The net debt of £29 million in PRL is also understood to be a loan facility used by Premiership Rugby to support club distributions in a normal course of business.

-

Inside that telegraph link, were these extras:

AT A GLANCE

Club-by-club | What financial shape is your side in?

By Ben ColesBath

Not a lot of serious red flags, albeit the level of debt has increased to an unsustainable level, which is mostly shareholder loans. The problem with Bath is that its operating structure will require continual propping up by Bruce Craig.Bristol

Bristol are OK as along as Steve Lansdown keeps on funding the club. He has a big cheque book but is happy to fund a business that has lost £30m over the past five years at the EBITDA (earnings before interest, taxes, depreciation, and amortisation) line. That is a passion.Exeter

Exeter have been much better at running its business than more or less all of the clubs. They have taken on more borrowings in Financial Year 21, but they have managed their business with a lot more vigilance.Gloucester

Gloucester would be on the fringe, but are not over-invested in hard assets, around £8.6m. They have a little bit of debt, bearing in mind some of that is the Covid loans from the Government, and were sensible to take that on.Harlequins

One club that is concerning is Harlequins. They borrowed £48m in FY21, maybe through £50m on the back of FY22. If you look at operating profit per employee, they are paying £60,000 per employee and going backwards. It's the structure of the business – big property investments, borrowings.Leicester Tigers

Their turnover averages £19-20m and they still incur losses, although they were more or less breaking even prior to Covid. Their latest net debt to revenue for FY21, with the debt being 0.8x their revenue, was their worst in the past six years but one of the league's best returns.London Irish

London Irish are challenged. They have never made a profit, have £30m worth of borrowings. It’s one club that’s potentially at high risk because of very low turnovers, at best in a good season of £10m.Newcastle Falcons

Another case of an unsustainable operating model, although in recent years have improved significantly. Club is also being propped up by a major shareholder increasing the loan over time. Too much debt for too little revenue.Northampton Saints

Probably managing better than most. Relatively low debt levels. Also seemed to manage the impact of Covid better than other clubs, reducing costs and managing to minimise the operational loss.Sale Sharks

Sale just run a club, they do not have any property. Their only problem is their operating costs are pretty chunky, which is why they could potentially be under pressure. They had the reprieve with the CVC payout, but ultimately it’s an unsustainable model.Saracens

Continued to incur significant losses of £30m over the last six years (up to FY21). Debt waived of £42m in FY18, resulting in nil debt for that year. However by the end of FY21 the net debt had leaped back to around £25m. While costs have declined, revenue was halved in FY21.and a graphic:

-

@Rapido Doesn't read well does it?

Funny thing is that on very simple terms that report is saying that free market capitalism doesn't work well in sporting comps and that a hefty degree of socialism is required. Trouble is that the backers/owners of the clubs are pretty much people that free market capitalism has served well in the past.

I'm glad that NZ went down the central contracting route from the start. It isn't always plain sailing but we also don't have the prospect of say a Hurricanes franchise crashing and burning off the field. It has also allowed the survival of the feeder tier of NPC despite that having even bigger challenges. If NPC teams were privately owned we would probably see teams like Ta$man in serious strife like they have been before.

I hope they sort it out because the global season also depends on NH clubs being on board and being able to look further than the bank manager.

-

@NTA said in Rugby Finances:

Oh sure the clubs are in financial trouble, but look at it this way:

"Now is the right time for more money"

-

@NTA said in Rugby Finances:

Oh sure the clubs are in financial trouble, but look at it this way:

Good luck to him, but nowhere on God's Green Earth is Finn Russell worth £1m

-

@MiketheSnow said in Rugby Finances:

@NTA said in Rugby Finances:

Oh sure the clubs are in financial trouble, but look at it this way:

Good luck to him, but nowhere on God's Green Earth is Finn Russell worth £1m

Which is the point I guess. These clubs are fucking mental

-

@MiketheSnow said in Rugby Finances:

@NTA said in Rugby Finances:

Oh sure the clubs are in financial trouble, but look at it this way:

Good luck to him, but nowhere on God's Green Earth is Finn Russell worth £1m

You’re not fucken wrong.

A couple of mill at the very least.

The guy is Rugby Jesus, you’d better recognise ! It makes absolutely no sense that a guy who is somehow simultaneously too skinny and too chubby to make it as a pro Rugby player is in this position yet here we are ( seriously, the only rig worse than his would be Andy Goode )

-

@Dan54 said in Rugby Finances:

Boy I get no joy out of seeing these clubs struggling, for whatever reason. London Irish going would be a shame.

They are being wound up by HMRC because of unpaid tax.

-

Entirely fair

-

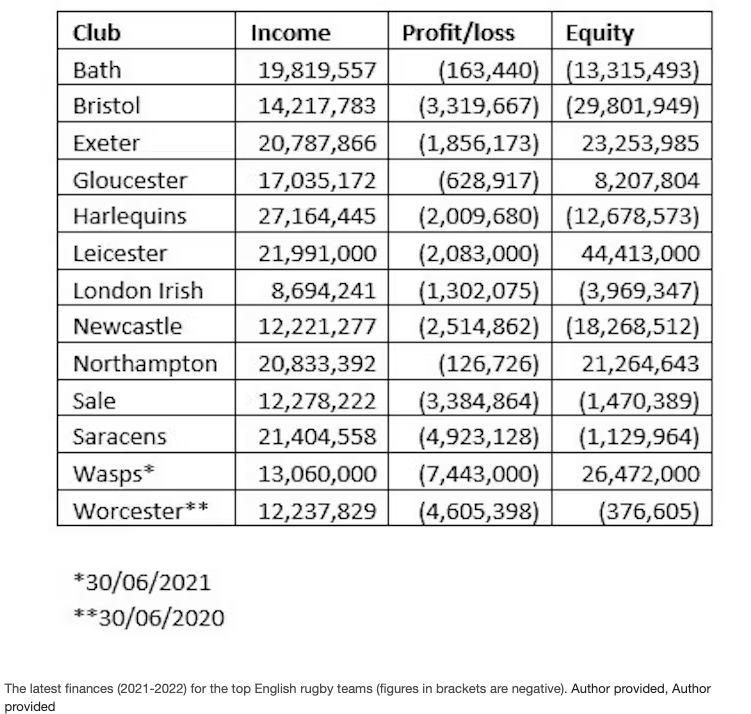

Another article on the PRL finances. Nothing new here ,except the table which includes an equity column. Which are the authors own figures.

Interesting to see the position of the clubs, by these metrics, that have fallen over - compared to the others.

Wasps collapsed because of the bond/lending markets freezing. Not because they had no equity. Although they were only a a few years from being in that position. Worcester were by no means in the worst position but had dodgy and uncommitted ownership.

Newcastle won't be around long, their owner isn't rich enough. As opposed to Bath, Bristol, Saracens for whom reality doesn't matter until they have no teams to play against.

Screenshot 2023-06-21 at 9.19.11 AM

-

@Nepia said in Rugby Finances:

TBH, English club rugby has lasted longer than I thought it would before imploding. When they first switched to professionalism I thought they'd go belly up in a few years.

Yes, it seems its been coming since the millenium. But a lot of thing in economics have defied norms for most of this millenium, so far.

I remember back in the very first year or so of professionalism. And rugby was still un-physical enough to allow mid-week matches. And was seeing some news clips of the first European cup, midweek floodlt matches, Martin Offiah etc on a temporary contract from league, playing for Quins IIRC. The future seemed their oyster then.

TO be fair to English clubs. Them (and the Scottish) started from the furtherest back at the dawn fo professionalism. Famous clubs like Wasps, Saracens, Irish, Scottish, Richmond, Rosslyn Park etc were litterally playing on suburban fields with only a clubhouse. Only Leicester and maybe Gloucester had any infrastructure to talk about.

Un-famous at the time, but big since, clubs like Worcester, Exeter, Newcastle have also started back in 1996 as suburban fields. To their credit they have built admirable infrastructure.

Just a shame they started day dot in player-salary la-la-land, and never fixed it. I remember Canterbury reserve (not Crusaders reserve, NPC reserve) Jamie Connolly (IIRC his name ...) moving from Canterbury to Harlequins in year 1 of professionalism for the same salaries that NZ Super 12 players were getting. E.g. NZ players 3 levels above his abilities. Famous 'Quins with their amateur connections to 'the city' playing triple the going rate from day dot, they were just a bit dumb.

Professional men’s rugby has major financial issues which need to be tackled

Professional men’s rugby has major financial issues which need to be tackled