Rugby Finances

-

The reports of how much the CVC stake would be seems to vary - with some saying more than £200m, and others saying £240m to make it an even £20m per club.

Except, if I recall correctly, there are 13 clubs who own stakes in the PRL - London Irish being the odd one out this season - so they would get a shareout from the investment - making the range from £15m - £18m per club.

Lastly, the central payments from RFU were based on performance for the second half of the agreement (2020-2024) so it is likely that the amount from RFU would decrease given their annual report figures being down - the RFU flagged this some months ago.

"Steve Brown has also spoken about how England's clubs could be set to suffer a decline in revenue from their financial deal with the RFU if Twickenham's forecast of a possible downturn in profit proves accurate.

He revealed the Professional Game Agreement (PGA) that underpins England's access to players from the Gallagher Premiership promises a fixed payment of £112million for the first four years only.

For 2020-24 of the eight-year deal, the amount received by clubs is linked to financial performance at the RFU, with Brown overseeing a redundancy process that is expected to see 62 people lose their job by the end of August to help offset rising fixed costs against an outlook of plateauing or reduced profit.

"The good thing about the PGA which we put in as a safety net was that the income part of it becomes flexible after the first four years, move with our finances," Brown said.

"If our income goes down, so does the agreement payment. So the PGA doesn't cause us a problem forever, it's just within the next two years.

"The clubs are already aware of this. That has always been the case. I guess from the clubs' point of view they have looked at securing their revenues for four years. They are fully informed." -

@des-lexic said in Rugby Finances:

@rapido

Hi New guy here. That summary of the English clubs is superb.It is indeed. Well done. But I'm not reading it ...

-

@rocky-rockbottom said in Rugby Finances:

Any relation to the Pondents? Or the Picables?

those fuckers are Blues fans fella

-

@antipodean said in Rugby Finances:

Sam Burgess?

Another megabucks RL "superstar" who didn't make the grade. Not quite as crap a player as Farrell Snr, but pretty close.

-

More on the RFU finances issue. The in-fighting has begun...

Love the "Respect and teamwork are two of rugby’s prized core values". Someone should tell Owen Farrell.....

Former chief executive and chairman of RFU stripped of 'privileged membership' for 'lack of respect'

"Francis Baron, the former chief executive of the Rugby Football Union, and Graeme Cattermole, a former chairman, have been stripped of their complimentary tickets and hospitality at Twickenham Tests after publicly raising concerns about its financial position.

The pair have been accused of showing “a lack of respect” after they claimed the RFU was in a perilous state, having written two reports analysing its financial affairs, details of which were published in The Daily Telegraph.

The RFU annual report published on Monday showed the governing body had made an operating loss of £30.9 million for 2017-18, although it said that was offset by a cash injection of £31.6 million from the restructuring of a Twickenham hospitality business. Steve Brown, the RFU chief executive, announced on the eve of England’s autumn international against Japan that he would step down from his £400,000 post at the end of the year, with insiders claiming he had become weary of “sniping and rugby politics”.

A motion to strip Baron, who was chief executive for 12 years before retiring in 2010, and Cattermole, who stepped down as chairman of the board in 2004, was proposed at council meeting at Twickenham last Friday and passed with a majority. Baron was told about the decision on Saturday morning and the RFU said in a letter it would honour the tickets he had for England’s victory over Australia that day, but that his privilege membership would be removed for the Six Nations Championship onwards.

Privilege membership is awarded to a small number of people each year in recognition of outstanding contributions to the game, and Baron was one of handful of former paid staff to have been granted it.Benefits include: two complimentary match tickets for Test matches at Twickenham, with the option to purchase four additional match tickets; one complimentary lunch, with the right to purchase an additional lunch; access for two to the members’ lounge, including free drinks; a complimentary dinner ticket, with the option to purchase an additional dinner ticket.

Chris Kelly, RFU president, said the decision to withdraw their “privilege membership” of the union had been taken because of a “lack of respect” shown by Baron and Cattermole in their criticism of the governing body.

“Respect and teamwork are two of rugby’s prized core values. Council awards privilege membership to a small number of people who have given outstanding service to the game and embody its core values,” Kelly said.

“At Friday’s Council meeting, members voted by an overwhelming majority to withdraw privilege membership from Francis Baron and Graeme Cattermole due to the clear lack of respect they have shown to the Union, our members and our staff.”

-

@victor-meldrew said in Rugby Finances:

More on the RFU finances issue. The in-fighting has begun...

Love the "Respect and teamwork are two of rugby’s prized core values". Someone should tell Owen Farrell.....

Any particular reason why? He's not renowned for lack of either.

-

Already on the NH Club Rugby thread.

Only Exeter in the black as Premiership Rugby racks up £50m in losses

• Twelve of the 13 clubs record increased deficitsAlthough this reporting is for the year to June 2018. To put in some perspective - A collective £50m in losses this year is already equal to a quarter of the incoming CVC investment. They're starting from further back than I thought.

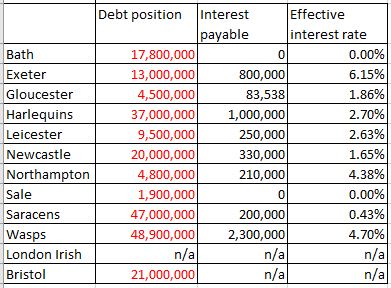

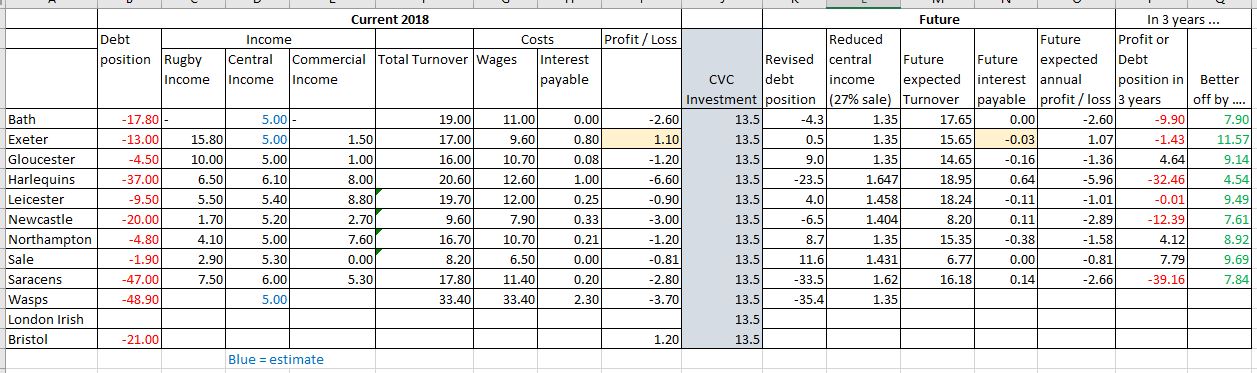

Here's a crappy spreadhseet I put together last year when trying to work out where the CVC investment would put the clubs based on the 2016/17 accounts from an earlier Guardian article from earlier in the thread. ( https://www.theguardian.com/sport/2018/aug/28/premiership-finances-the-full-club-by-club-breakdown-and-verdict )

But to be honest, I struggled to place how the reduced interest payments for the well run clubs would offset the reduced central payments. From the numbers supplied in the Guardian article.

So have ignored interest costs in the future for simplicity, as some aren't paying interest anyway on the sugar daddy loans.

This is also ignores potential increases in revenue. It is just to demonstrate how quickly the CVC money will get hoovered up (or Dysoned up in Bath) under the status quo.

Anyway, I'll link it anyway.

-

New Harlequins stadium, Northampton signings - what EVERY Premiership club need to buy

KERR-CHING. English club rugby is suddenly awash with cash.

By NEIL SQUIRES

PUBLISHED: 18:00, Mon, Apr 8, 2019

The long-awaited deposit of £13m from private equity investors CVC has finally landed in the bank accounts of all 12 top-flight English clubs and Championship leaders London Irish, as the 13th shareholder in Premiership Rugby.

It is effectively tomorrow’s money from TV and sponsorship deals today – income in future seasons will drop unless CVC, who now own a 27 per cent stake in Premiership Rugby, can leverage significant increases in marketing revenue.

This means it should be guarded carefully and used sparingly.

For more than 20 years the clubs have talked of balancing their books and turning the domestic game into a profitable enterprise only to overspend every season.

Despite record income levels, the Premiership is lose around £30m per year.

Bath were the most recent club to return their figures last week. ‘Bath Rugby reports a year of revenue growth and increased investment,’ trumpeted Premiership Rugby.

They reported a £3.1m loss after tax, up from £2.5m the previous year.

The clubs just can’t resist the temptation - the cash will be splashed. But what on? Each one has a different priority.

Bath – Bricks and mortar. The long-running saga over a home to match Bath’s heritage goes on with the latest version an 18,000-capacity stadium on The Rec the dream for the 2021/22 season. They don’t come cheap - £60m is the estimate - but they will still probably sign a world-class stand-off while they’re at it with former All Black Aaron Cruden one of several linked with the club.

Bristol - Gareth Anscombe. The Wales stand-off has been offered £500,000 to turn his back on Test rugby after the World Cup and join the club. Nathan Hughes and Dave Attwood are also on his way to the free spenders who already have the highest-paid player in the Premiership, Charles Piutau, who is on £950,000 per year.

Exeter – Rob Baxter. The Chiefs director of rugby is a frontrunner to replace Eddie Jones as England coach if, as expected, he leaves after the World Cup and if he took the job and moved his coaching staff with him to Twickenham it would rip the heart out of the club. Buy him Devon. Stuart Hogg is also on his way.

Harlequins – A new Stoop. Quins have plans in place to upgrade their current 14,800-capacity home into a 25,000 stadium with an artificial pitch at a cost of around £50m. Had a stab at prising Beauden Barrett away from the All Blacks only to miss out but have Argentina scrum-half Martin Landajo on the way.

Gloucester – Danny Cipriani. The stand-off has made such a difference to Gloucester since his arrival at the start of the season that the club’s success in talking him into signing an enhanced three-year deal last week could be the trigger for big things.

Leicester – Year-round players. It’s all very well splashing out to keeping Manu Tuilagi and the Tigers’ other England internationals but if they are half the side when they’re missing they are vulnerable as this nightmare season has shown. Jordan Taufua from the Crusaders and Pumas forward Thomas Lavanini are on the way.

Newcastle – Spending up to the salary cap. Holding onto their own players, never mind signing others is a challenge with the smallest budget in the league. Kingston Park could also do with a few quid spent on it.

Northampton – New Zealanders. Kiwi director of rugby Chris Boyd has All Blacks rock Owen Franks on the way from the Crusaders plus Matt Proctor from the Hurricanes. They are unlikely to be the last from that part of the world.

Sale – South Africans. Steve Diamond may have missed out on the ginger ninja Steven Kitshoff but Akker van der Merwe and the du Preez brothers are on their way to join Faf de Klerk and Rohan Janse van Rensburg at the AJ Bell Stadium.

Saracens – The best accountants around. They are needed to somehow keep the champions within the salary cap with yet another England international, Elliot Daly, coming on board next season.

Wasps – Plug for the club’s financial black hole. They lost an eye-watering £9.7m last year and some of their biggest names, including Willie le Roux, will leave at the end of the season. They still need to pay the salary of the incoming Malakai Fekitoa from Toulon though.

Worcester – Reputation reshape. Annual relegation struggle makes Sixways unattractive for signings so cash injection will help on that front and enable the Warriors to keep their promising youngsters like Ted Hill.

-

-

Changes in debt position. For those clubs who's pofit or loss was mentioned in the article (https://www.theguardian.com/sport/2019/apr/08/exeter-in-the-black-premiership-rugby-losses-year-to-june-2018)

-

Saracens will be further investigated by Premiership Rugby for a potential breach of salary cap regulations relating to the club’s co-investment arrangements with a number of their high-profile players.

Premiership Rugby said on Wednesday night that Saracens had not disclosed details of all of their arrangements when they were first reported in March. The arrangements involve the Saracens owner, Nigel Wray, sharing businesses with players such as Owen Farrell, Maro Itoje and Mako and Billy Vunipola, as well as co-owning houses with former players.

Saracens issued a swift response, blaming a “minor internal oversight” but Premiership Rugby will continue its review into the current champions. All clubs must adhere to the £7m salary cap – which does not include two marquee players – with punishments ranging from potential fines to points deductions.

Saracens have previously insisted that they have disclosed all of their investments with players, with Wray insisting last month that “we proactively disclose co-investments when they occur, even though we are under no obligation to do so”. But on Wednesday Premiership Rugby insisted that “clubs are required to supply information to the Premiership Rugby salary cap manager on any arrangements between a connected party and a player which might constitute payment or benefit in kind”.

Wray has staunchly defended his business ventures with his players and last month issued a lengthy statement, again insisting that his co-investments are not part of Premiership’s salary regulations. “I recognise that in some quarters, these co-investments are perceived as part of the Premiership salary regulations,” he said. “They are not. Investment is not salary.”

Saracens’ statement on Wednesday was similarly insistent. “Whilst co-investments are not part of the salary regulations, we disclosed these transactions in good faith and indeed divulged more information than was necessary. We remain confident that we comply with the salary regulations and will continue to support the entrepreneurial spirit and future of our players.”

Premiership Rugby’s statement, however, comes just 24 hours after its first board meeting since Wray’s arrangements with his players came to light. The statement continued: “The information now received from the club and various parties will be reviewed. Premiership Rugby will make no further comment at this stage.”

-

at the other end of the scale...

from February.

Running both the semi-professional magpies, and being responsible for amateur club rugby and youth rep rugby etc. A NZ provincial union has to be more responsible. (except Otago ....)

https://www.nzherald.co.nz/hawkes-bay-today/sport/news/article.cfm?c_id=1503460&objectid=12207610

Rugby: Union in black for 20th consecutive year

Embarking on an expense-cutting mission saw the Hawke's Bay Rugby Union post a surplus in excess of $100,000 last year.

Details of the 20th consecutive surplus were revealed at tonight's 134th annual meeting in Napier attended by 63 people.

Speaking before the meeting, union chief executive Jay Campbell said the $109,934 surplus recorded during the financial year ending on November 30 was $99,168 more than budgeted for.

"We didn't replace staff during a period last year. We've just started doing that during the last three months." Campbell pointed out the union didn't have a commercial manager for six months and he combined that role with his job until Dan Somerville returned to the union.

Total revenue dropped by $121,671 to $4,142,488.

Campbell said a key factor in this drop was Israel Dagg missing out on the All Blacks.

"We get extra money from the New Zealand union if any of our players make the All Blacks Championship squad."

However, for the third consecutive year the union's equity was more than $1 million — $1,277,426 to be precise, an increase of $107,934 on last year.

The New Zealand Rugby Union's grant dropped by $38,612 to $1,592,131.

Total expenses for the union dropped $211,924 to $4,019,037.

Expenses for the Magpies amounted to $1,772,577 which was $19,724 less than the previous year.

-

and now some bad provincial news ...

One of New Zealand's proudest rugby unions is in danger of financial ruin.

Taranaki posted a loss of just under NZ$1million last year, primarily due to the limited use of their New Plymouth home ground Yarrow Stadium.

The pain is real for the union's top side and its quest to stay competitive, particularly for a union that boasts a proud history in provincial rugby.

A maiden national provincial title in 2014 and six successful Ranfurly Shield tenures - the most recent two years ago

Taranaki's given New Zealand rugby names like Barrett, Crowley and Loveridge, but now the outlook is bleak, mostly because they can't fully utilise their home ground.

Yarrow Stadium's two main grandstands are considered an earthquake risk.

"We've had to strip out a lot of costs of Taranaki Rugby across all departments," said chief executive Jeremy Parkinson.

"The biggest focus being on the Mitre 10 Cup, one the team and two the management."

Effectively - the union's ability to attract and then keep players is severely limited.

Currently, they can't sign players for more than a year. Their squad is full of talent on limited paying deals.

"The reality is we now have minimum contracts for our players," Parkinson said.

On top of that they can only afford one full-time support staff member- that's head coach Willie Rickards.

"Previously, with a fully functioning Yarrow Stadium, we've had the ability to go out and recruit at a high level; whereas that's not the case now," said Parkinson.

The situation is personal for first five Stephen Perofeta. The Blues and Taranaki playmaker said he owes a lot to the amber and blacks.

"The Naki gave me an opportunity to come straight out of school into a welcoming environment where I was able to grow, not only in rugby but as a person," he said.

Yarrow Stadium's future is now at a public consultation phase, but the Taranaki regional council wants an NZ$55million upgrade of both stands.

"We have really good staff and really passionate supporters, so we're calling on them this year to get behind us," said Parkinson.

The Taranaki Rugby Union desperately need help to end their troubles.

Newshub.

-

jesus that's rough. Is it a case of changed standards? or the initial design not up to scratch?

That is a shit ton of money for anybody to come up with, let alone a provincial rugby union.

stadiums are such a massive risk.

-

@Machpants said in Rugby Finances:

Goota feel sorry for them, 'oh here's a 55 million present for you, a MINUS 55 million one'

The Taranaki RFU don't own it though. Maybe they did own it back in the distant past when it was Rugby Park. But generally in the 90's & 2000's these old provincial rugby grounds passed into council hands when came time to upgrade them to modern standards. E.g. the Hamilton Rugby Park to Waikato Stadium model.

Yarrow Stadium is owned by the Taranaki Stadium Trust. It is operated by the New Plymouth District Council.

The Taranaki Stadium Trust - which is controlled by the Taranaki Regional Council -- took over ownership of the stadium from the New Plymouth District Council in 2014.

https://www.stuff.co.nz/national/108035138/taranakis-yarrow-stadium-owner-incurs-157m-annual-loss

-

Here's an interesting example of a traditional rugby ground bouncing backwards and forwards between rugby union and council ownership.

Fraser Park in Timaru.

From June 2016:

https://www.stuff.co.nz/timaru-herald/sport/80947955/south-canterbury-rugby-gets-sole-ownership-of-alpine-energy-stadiumThe South Canterbury Rugby Union is set to become the sole owner of Alpine Energy Stadium after reaching terms with the Timaru District Council.

The Fraser Park Trust announced the agreement for the transfer on Friday.

Trust chairman and Timaru councillor Tony Brien said it was an important day for rugby in South Canterbury.

"The Timaru District Council came to the rescue of Fraser Park in 1989 when the financial downturn put the union, along with many other organisations, under pressure".

The 1989 rescue package involved the creation of the Fraser Park Trust and a $240,000 contribution by the council.

SCRU chairman Ray Teahen said he was delighted with the outcome.

"This has been a complex process where we have all had to be mindful of the historical situation, the responsibility of the TDC to ratepayers and other sports organisations, and the responsibility of the union to the 2,500 rugby players and their clubs in South Canterbury.

"The union is financially stable with a strong balance sheet and able to take up the responsibility for a large and valuable community asset."

The agreement sees the assets transferred into a new trust to be called the Fraser Park Community Trust and the original council contribution converted to a new 15 year loan secured by a mortgage over the stadium.

As the rugby union undertakes a number of capital developments to the stadium the value of these developments will be written off against the loan.

The write off will be deemed to be the TDC's contribution to capital developments, although they will be funded from union reserves.

No firm decisions have been made on what those capital developments will be.

Brien said the approach complies with council policy by ensuring that council funds are applied to going development and modernisation of sports facilities in Timaru.

Teahen said the union will begin a process of evaluating the facilities and what will be the best investments for the future development of the stadium.

"These decisions will involve wide consultation with the rugby community and may include an upgrade of the playing surfaces, upgraded safety arrangements between vehicles and pedestrians, dedicated changing and shower facilities for women and girls' teams, and referees' facilities."

"We are all excited by the possibilities in front of us and the union would especially like to express its appreciation for the support the Timaru District Council has given to the Fraser Park Trust over many years and for the encouragement to us to make this community facility something Timaru can be proud of in to the future."

The stand-off between the council and union started in January last year over the council's vested interest.

The union wanted to upgrade Alpine Energy Stadium's facilities and unwind the trust which owned the stadium. They believed there was little benefit in the trust structure, while the extra layer of ownership was restrictive to development.

The trust's founding document was however somewhat sketchy and no repayment details had been mentioned or had ever been made.

The point of contention was around whether the money given to the union over 20 years ago was in fact a council loan or a grant, but that has been resolved to both parties satisfaction.

The 3.7493ha stadium has a capital rateable value of $2,120,000 of which $510,000 is land value.