Rugby Finances

-

@victor-meldrew said in Rugby Finances:

More on the RFU finances issue. The in-fighting has begun...

Love the "Respect and teamwork are two of rugby’s prized core values". Someone should tell Owen Farrell.....

Any particular reason why? He's not renowned for lack of either.

-

Already on the NH Club Rugby thread.

Only Exeter in the black as Premiership Rugby racks up £50m in losses

• Twelve of the 13 clubs record increased deficitsAlthough this reporting is for the year to June 2018. To put in some perspective - A collective £50m in losses this year is already equal to a quarter of the incoming CVC investment. They're starting from further back than I thought.

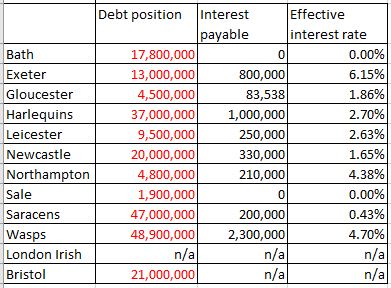

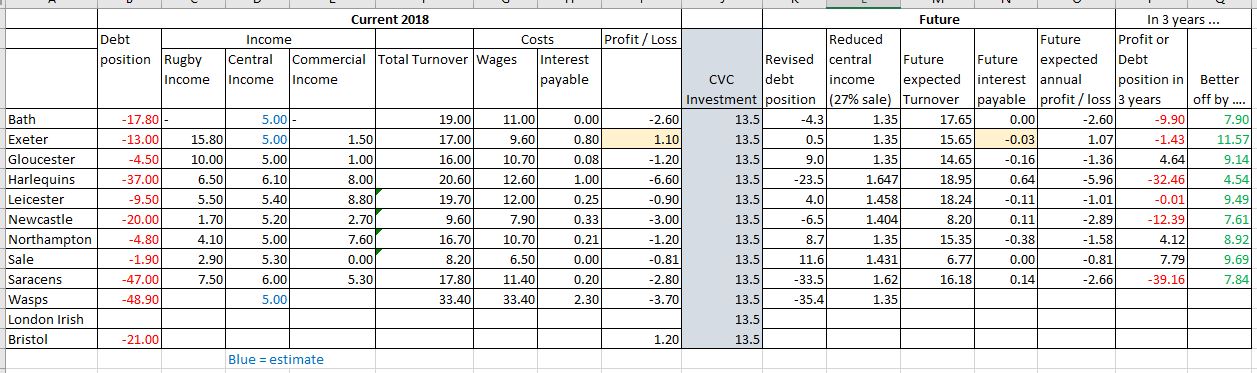

Here's a crappy spreadhseet I put together last year when trying to work out where the CVC investment would put the clubs based on the 2016/17 accounts from an earlier Guardian article from earlier in the thread. ( https://www.theguardian.com/sport/2018/aug/28/premiership-finances-the-full-club-by-club-breakdown-and-verdict )

But to be honest, I struggled to place how the reduced interest payments for the well run clubs would offset the reduced central payments. From the numbers supplied in the Guardian article.

So have ignored interest costs in the future for simplicity, as some aren't paying interest anyway on the sugar daddy loans.

This is also ignores potential increases in revenue. It is just to demonstrate how quickly the CVC money will get hoovered up (or Dysoned up in Bath) under the status quo.

Anyway, I'll link it anyway.

-

New Harlequins stadium, Northampton signings - what EVERY Premiership club need to buy

KERR-CHING. English club rugby is suddenly awash with cash.

By NEIL SQUIRES

PUBLISHED: 18:00, Mon, Apr 8, 2019

The long-awaited deposit of £13m from private equity investors CVC has finally landed in the bank accounts of all 12 top-flight English clubs and Championship leaders London Irish, as the 13th shareholder in Premiership Rugby.

It is effectively tomorrow’s money from TV and sponsorship deals today – income in future seasons will drop unless CVC, who now own a 27 per cent stake in Premiership Rugby, can leverage significant increases in marketing revenue.

This means it should be guarded carefully and used sparingly.

For more than 20 years the clubs have talked of balancing their books and turning the domestic game into a profitable enterprise only to overspend every season.

Despite record income levels, the Premiership is lose around £30m per year.

Bath were the most recent club to return their figures last week. ‘Bath Rugby reports a year of revenue growth and increased investment,’ trumpeted Premiership Rugby.

They reported a £3.1m loss after tax, up from £2.5m the previous year.

The clubs just can’t resist the temptation - the cash will be splashed. But what on? Each one has a different priority.

Bath – Bricks and mortar. The long-running saga over a home to match Bath’s heritage goes on with the latest version an 18,000-capacity stadium on The Rec the dream for the 2021/22 season. They don’t come cheap - £60m is the estimate - but they will still probably sign a world-class stand-off while they’re at it with former All Black Aaron Cruden one of several linked with the club.

Bristol - Gareth Anscombe. The Wales stand-off has been offered £500,000 to turn his back on Test rugby after the World Cup and join the club. Nathan Hughes and Dave Attwood are also on his way to the free spenders who already have the highest-paid player in the Premiership, Charles Piutau, who is on £950,000 per year.

Exeter – Rob Baxter. The Chiefs director of rugby is a frontrunner to replace Eddie Jones as England coach if, as expected, he leaves after the World Cup and if he took the job and moved his coaching staff with him to Twickenham it would rip the heart out of the club. Buy him Devon. Stuart Hogg is also on his way.

Harlequins – A new Stoop. Quins have plans in place to upgrade their current 14,800-capacity home into a 25,000 stadium with an artificial pitch at a cost of around £50m. Had a stab at prising Beauden Barrett away from the All Blacks only to miss out but have Argentina scrum-half Martin Landajo on the way.

Gloucester – Danny Cipriani. The stand-off has made such a difference to Gloucester since his arrival at the start of the season that the club’s success in talking him into signing an enhanced three-year deal last week could be the trigger for big things.

Leicester – Year-round players. It’s all very well splashing out to keeping Manu Tuilagi and the Tigers’ other England internationals but if they are half the side when they’re missing they are vulnerable as this nightmare season has shown. Jordan Taufua from the Crusaders and Pumas forward Thomas Lavanini are on the way.

Newcastle – Spending up to the salary cap. Holding onto their own players, never mind signing others is a challenge with the smallest budget in the league. Kingston Park could also do with a few quid spent on it.

Northampton – New Zealanders. Kiwi director of rugby Chris Boyd has All Blacks rock Owen Franks on the way from the Crusaders plus Matt Proctor from the Hurricanes. They are unlikely to be the last from that part of the world.

Sale – South Africans. Steve Diamond may have missed out on the ginger ninja Steven Kitshoff but Akker van der Merwe and the du Preez brothers are on their way to join Faf de Klerk and Rohan Janse van Rensburg at the AJ Bell Stadium.

Saracens – The best accountants around. They are needed to somehow keep the champions within the salary cap with yet another England international, Elliot Daly, coming on board next season.

Wasps – Plug for the club’s financial black hole. They lost an eye-watering £9.7m last year and some of their biggest names, including Willie le Roux, will leave at the end of the season. They still need to pay the salary of the incoming Malakai Fekitoa from Toulon though.

Worcester – Reputation reshape. Annual relegation struggle makes Sixways unattractive for signings so cash injection will help on that front and enable the Warriors to keep their promising youngsters like Ted Hill.

-

-

Changes in debt position. For those clubs who's pofit or loss was mentioned in the article (https://www.theguardian.com/sport/2019/apr/08/exeter-in-the-black-premiership-rugby-losses-year-to-june-2018)

-

Saracens will be further investigated by Premiership Rugby for a potential breach of salary cap regulations relating to the club’s co-investment arrangements with a number of their high-profile players.

Premiership Rugby said on Wednesday night that Saracens had not disclosed details of all of their arrangements when they were first reported in March. The arrangements involve the Saracens owner, Nigel Wray, sharing businesses with players such as Owen Farrell, Maro Itoje and Mako and Billy Vunipola, as well as co-owning houses with former players.

Saracens issued a swift response, blaming a “minor internal oversight” but Premiership Rugby will continue its review into the current champions. All clubs must adhere to the £7m salary cap – which does not include two marquee players – with punishments ranging from potential fines to points deductions.

Saracens have previously insisted that they have disclosed all of their investments with players, with Wray insisting last month that “we proactively disclose co-investments when they occur, even though we are under no obligation to do so”. But on Wednesday Premiership Rugby insisted that “clubs are required to supply information to the Premiership Rugby salary cap manager on any arrangements between a connected party and a player which might constitute payment or benefit in kind”.

Wray has staunchly defended his business ventures with his players and last month issued a lengthy statement, again insisting that his co-investments are not part of Premiership’s salary regulations. “I recognise that in some quarters, these co-investments are perceived as part of the Premiership salary regulations,” he said. “They are not. Investment is not salary.”

Saracens’ statement on Wednesday was similarly insistent. “Whilst co-investments are not part of the salary regulations, we disclosed these transactions in good faith and indeed divulged more information than was necessary. We remain confident that we comply with the salary regulations and will continue to support the entrepreneurial spirit and future of our players.”

Premiership Rugby’s statement, however, comes just 24 hours after its first board meeting since Wray’s arrangements with his players came to light. The statement continued: “The information now received from the club and various parties will be reviewed. Premiership Rugby will make no further comment at this stage.”

-

at the other end of the scale...

from February.

Running both the semi-professional magpies, and being responsible for amateur club rugby and youth rep rugby etc. A NZ provincial union has to be more responsible. (except Otago ....)

https://www.nzherald.co.nz/hawkes-bay-today/sport/news/article.cfm?c_id=1503460&objectid=12207610

Rugby: Union in black for 20th consecutive year

Embarking on an expense-cutting mission saw the Hawke's Bay Rugby Union post a surplus in excess of $100,000 last year.

Details of the 20th consecutive surplus were revealed at tonight's 134th annual meeting in Napier attended by 63 people.

Speaking before the meeting, union chief executive Jay Campbell said the $109,934 surplus recorded during the financial year ending on November 30 was $99,168 more than budgeted for.

"We didn't replace staff during a period last year. We've just started doing that during the last three months." Campbell pointed out the union didn't have a commercial manager for six months and he combined that role with his job until Dan Somerville returned to the union.

Total revenue dropped by $121,671 to $4,142,488.

Campbell said a key factor in this drop was Israel Dagg missing out on the All Blacks.

"We get extra money from the New Zealand union if any of our players make the All Blacks Championship squad."

However, for the third consecutive year the union's equity was more than $1 million — $1,277,426 to be precise, an increase of $107,934 on last year.

The New Zealand Rugby Union's grant dropped by $38,612 to $1,592,131.

Total expenses for the union dropped $211,924 to $4,019,037.

Expenses for the Magpies amounted to $1,772,577 which was $19,724 less than the previous year.

-

and now some bad provincial news ...

One of New Zealand's proudest rugby unions is in danger of financial ruin.

Taranaki posted a loss of just under NZ$1million last year, primarily due to the limited use of their New Plymouth home ground Yarrow Stadium.

The pain is real for the union's top side and its quest to stay competitive, particularly for a union that boasts a proud history in provincial rugby.

A maiden national provincial title in 2014 and six successful Ranfurly Shield tenures - the most recent two years ago

Taranaki's given New Zealand rugby names like Barrett, Crowley and Loveridge, but now the outlook is bleak, mostly because they can't fully utilise their home ground.

Yarrow Stadium's two main grandstands are considered an earthquake risk.

"We've had to strip out a lot of costs of Taranaki Rugby across all departments," said chief executive Jeremy Parkinson.

"The biggest focus being on the Mitre 10 Cup, one the team and two the management."

Effectively - the union's ability to attract and then keep players is severely limited.

Currently, they can't sign players for more than a year. Their squad is full of talent on limited paying deals.

"The reality is we now have minimum contracts for our players," Parkinson said.

On top of that they can only afford one full-time support staff member- that's head coach Willie Rickards.

"Previously, with a fully functioning Yarrow Stadium, we've had the ability to go out and recruit at a high level; whereas that's not the case now," said Parkinson.

The situation is personal for first five Stephen Perofeta. The Blues and Taranaki playmaker said he owes a lot to the amber and blacks.

"The Naki gave me an opportunity to come straight out of school into a welcoming environment where I was able to grow, not only in rugby but as a person," he said.

Yarrow Stadium's future is now at a public consultation phase, but the Taranaki regional council wants an NZ$55million upgrade of both stands.

"We have really good staff and really passionate supporters, so we're calling on them this year to get behind us," said Parkinson.

The Taranaki Rugby Union desperately need help to end their troubles.

Newshub.

-

jesus that's rough. Is it a case of changed standards? or the initial design not up to scratch?

That is a shit ton of money for anybody to come up with, let alone a provincial rugby union.

stadiums are such a massive risk.

-

@Machpants said in Rugby Finances:

Goota feel sorry for them, 'oh here's a 55 million present for you, a MINUS 55 million one'

The Taranaki RFU don't own it though. Maybe they did own it back in the distant past when it was Rugby Park. But generally in the 90's & 2000's these old provincial rugby grounds passed into council hands when came time to upgrade them to modern standards. E.g. the Hamilton Rugby Park to Waikato Stadium model.

Yarrow Stadium is owned by the Taranaki Stadium Trust. It is operated by the New Plymouth District Council.

The Taranaki Stadium Trust - which is controlled by the Taranaki Regional Council -- took over ownership of the stadium from the New Plymouth District Council in 2014.

https://www.stuff.co.nz/national/108035138/taranakis-yarrow-stadium-owner-incurs-157m-annual-loss

-

Here's an interesting example of a traditional rugby ground bouncing backwards and forwards between rugby union and council ownership.

Fraser Park in Timaru.

From June 2016:

https://www.stuff.co.nz/timaru-herald/sport/80947955/south-canterbury-rugby-gets-sole-ownership-of-alpine-energy-stadiumThe South Canterbury Rugby Union is set to become the sole owner of Alpine Energy Stadium after reaching terms with the Timaru District Council.

The Fraser Park Trust announced the agreement for the transfer on Friday.

Trust chairman and Timaru councillor Tony Brien said it was an important day for rugby in South Canterbury.

"The Timaru District Council came to the rescue of Fraser Park in 1989 when the financial downturn put the union, along with many other organisations, under pressure".

The 1989 rescue package involved the creation of the Fraser Park Trust and a $240,000 contribution by the council.

SCRU chairman Ray Teahen said he was delighted with the outcome.

"This has been a complex process where we have all had to be mindful of the historical situation, the responsibility of the TDC to ratepayers and other sports organisations, and the responsibility of the union to the 2,500 rugby players and their clubs in South Canterbury.

"The union is financially stable with a strong balance sheet and able to take up the responsibility for a large and valuable community asset."

The agreement sees the assets transferred into a new trust to be called the Fraser Park Community Trust and the original council contribution converted to a new 15 year loan secured by a mortgage over the stadium.

As the rugby union undertakes a number of capital developments to the stadium the value of these developments will be written off against the loan.

The write off will be deemed to be the TDC's contribution to capital developments, although they will be funded from union reserves.

No firm decisions have been made on what those capital developments will be.

Brien said the approach complies with council policy by ensuring that council funds are applied to going development and modernisation of sports facilities in Timaru.

Teahen said the union will begin a process of evaluating the facilities and what will be the best investments for the future development of the stadium.

"These decisions will involve wide consultation with the rugby community and may include an upgrade of the playing surfaces, upgraded safety arrangements between vehicles and pedestrians, dedicated changing and shower facilities for women and girls' teams, and referees' facilities."

"We are all excited by the possibilities in front of us and the union would especially like to express its appreciation for the support the Timaru District Council has given to the Fraser Park Trust over many years and for the encouragement to us to make this community facility something Timaru can be proud of in to the future."

The stand-off between the council and union started in January last year over the council's vested interest.

The union wanted to upgrade Alpine Energy Stadium's facilities and unwind the trust which owned the stadium. They believed there was little benefit in the trust structure, while the extra layer of ownership was restrictive to development.

The trust's founding document was however somewhat sketchy and no repayment details had been mentioned or had ever been made.

The point of contention was around whether the money given to the union over 20 years ago was in fact a council loan or a grant, but that has been resolved to both parties satisfaction.

The 3.7493ha stadium has a capital rateable value of $2,120,000 of which $510,000 is land value.

-

and on that subject of the SCRFU and Fraser Park.

Here is a recent update. Good news.

South Canterbury Rugby's redevelopment plans for Alpine Energy Stadium get $500k boost

-

Not strictly a "rugby finance" article. But is a good read. About Forsyth Barr Stadium.

From Saturday, 16 February 2019

It is 10 years since a major vote in Dunedin’s Municipal Chambers gave the green light for the Forsyth Barr Stadium. The venue has been racking up successes attracting concerts recently, but the bitter debate at its inception come at both a financial and emotional cost to the city. David Loughrey speaks to those involved.

-

Thursday, 4 October 2018

'Stellar year' sees stadium manager in the black, again

The company running Forsyth Barr Stadium has delivered its third consecutive profit, and the man in charge hopes the days of losses are behind it.

Dunedin Venues' annual report for 2017-18 showed the company made a $602,000 after-tax profit in the year to June 30, up from $299,000 the previous year.

Dunedin Venues chief executive Terry Davies said the ''stellar year'' reflected the string of significant events staged at the stadium during the period.

That included an All Blacks Bledisloe Cup test match, but also concerts by Stevie Nicks and The Pretenders, Roger Waters, Robbie Williams and three massive shows by Ed Sheeran.

The success of those events was reflected in visitor statistics, which showed more people (263,000) attended music concerts at the stadium than Highlanders or All Blacks rugby fixtures (133,700) during the period.

Mr Davies said that showed the venue's success in diversifying its business in recent years, which also reduced the financial risk to ratepayers should it miss out on any one event, like an All Blacks test.

''You'd never have dreamt those sorts of numbers coming through for concerts four years ago. It was always rugby-dominated. It shows a shift in the business.

''We need to sustain that. We want that to be the model.''

The profit was a ''good result'' that would be reinvested into the business, covering maintenance and improvements and allowing it to grow, he said.

''We're not sitting on our hands. We're looking to improve our business all the time.

''We need to deliver surpluses to get to where we want to be.''

Rugby remained an important part of the stadium mix, but the venue still needed to be used more, and draw bigger crowds more often, he said.

''We've still got a way to go yet.''

Despite that, he was confident the days of the company's deficits were over.

''There's no way we would do that.

Putting all your eggs in one basket is high-risk, and we're trying to spread that risk.''

Having concerts by Stevie Nicks and The Pretenders, Roger Waters, Robbie Williams and three shows by Ed Sheeran all in one financial year, is quite amazing. (plus a Bledisloe Cup test match)

-

Although Dunedin rate payers are still paying the borrowing costs to build the stadium, with no dividends yet from the stadium profits. The stadium oerating profits (and the buidings depecraiaction tax write offs) are mixed up in Dunedin City Holdings Ltd. The stadium was planned in 2011 to deliver an $8m annual dividen to the council.

Council-owned companies such as Dunedin Venues paid an annual dividend to their parent body, Dunedin City Holdings Ltd, which in turn should make dividend and interest payments to its shareholder, the council.

Since 2011 DCHL's total annual payment had dropped from $23.2 million a year to $11.152 million in 2015-16, when dividends ceased completely. (But this has much to do with rotting power poles, as sports facilities)

Although "In the meantime, DCHL would continue to make interest payments to the council worth $5.9 million a year."

Dunedin City Holdings Ltd owns:

- Aurora (Electricity Lines Company)

- Delta (Electricity Lines Company)

- Dunedin Venues Ltd

- Dunedin Stadium Property Ltd

- Dunedin Railways Ltd - formerly Taieri Gorge Railway Ltd

- Dunedin Airport

- City Forests

from: https://www.odt.co.nz/news/dunedin/dchl-group-posts-profit

Thursday, 1 March 2018the previous year, and of $2.169 million for Dunedin Airport, up from $1.72 million the previous year.

Aurora and Delta's six-month results both dipped slightly from the corresponding period last year, following the separation of the two companies' boards, staffing and management structures.

Delta's after-tax surplus was $1.67 million, down from $1.84 million, while Aurora's was $3.15 million, down from $4.03 million.

Dunedin Venues Ltd, the company running Forsyth Barr Stadium, recorded a small but improving six-month after-tax profit of $298,000, up from $77,000 for the same period the previous year.

Dunedin Railways Ltd - formerly Taieri Gorge Railway Ltd - recorded a worse-than-expected after-tax loss of $634,000, up from the previous year's six-month $470,000 loss.

That was due in part to last year's July storm, which cost the company $385,000 in track repairs and $175,000 in lost income.

Dunedin Stadium Property Ltd - formerly Dunedin Venues Ltd, which owns the stadium building - posted a six-month loss of $4.2 million, as expected, up from $3.2 million. That largely comprised a non-cash book loss of $3.5 million a year, representing depreciation, staff said.

DCHL chairman Graham Crombie said he was pleased with the ''positive financial result once again''.

''Our half-year result is in line with our budget projections and our continued strong operating cash flow will provide a stable basis for the coming months and years.''

City Forests' result was primarily driven by strong international and domestic markets, and favourable shipping costs, while Dunedin Airport enjoyed an increase in landing charges and passenger numbers.

Aurora's increasing investment in its network maintenance showed in its capital expenditure, up nearly $16 million to $38.07 million, and higher group debt, while Delta's revenue was down largely due to the new contracting arrangements between it and Aurora.

-

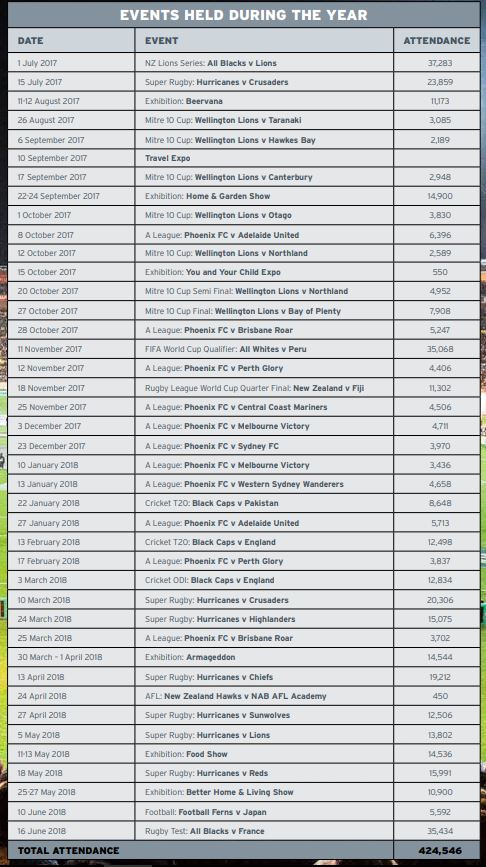

Westpac Stadiums most recent financial report.

https://www.westpacstadium.co.nz/fileadmin/images/content/WRST_AR18.pdf

Westpac Stadium hosted a total of 50 major event days for the year, plus

several community event days. Over 424,000 fans attended events during the

12 months, with the cumulative attendance since opening now at 9.73 million.

To keep it rugby related. Rugby attendance was 51% (217,243 out of the 424,546). Which was an exceptional year with 2 All Back tests falling within the FY.