Rugby Finances

-

LOL RFU report made them realise things weren't so rosy after all. This'll be a long term disaster for PR (it's ALL about the money ow, not just mostly) and short term for SH (more money for our players).When it all goes tits up in 5 years time, who knows how it will pan out.

-

If they're only selling a minority stake in the region of 30% as mentioned in article above.

And they're getting crica £240m as Guardian article suggests.

Then that's probably a pretty good deal. Would have to look into it.

With the previous offer, in one of the other threads I reckoned that the £275m offer for 50% stake would only delay the day of reckoning for the lower half of the league by a few years until back to square 1.

-

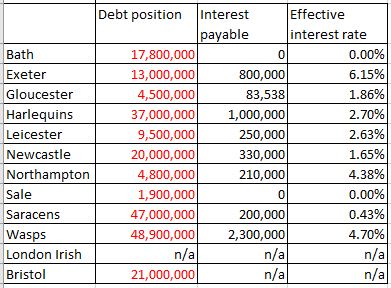

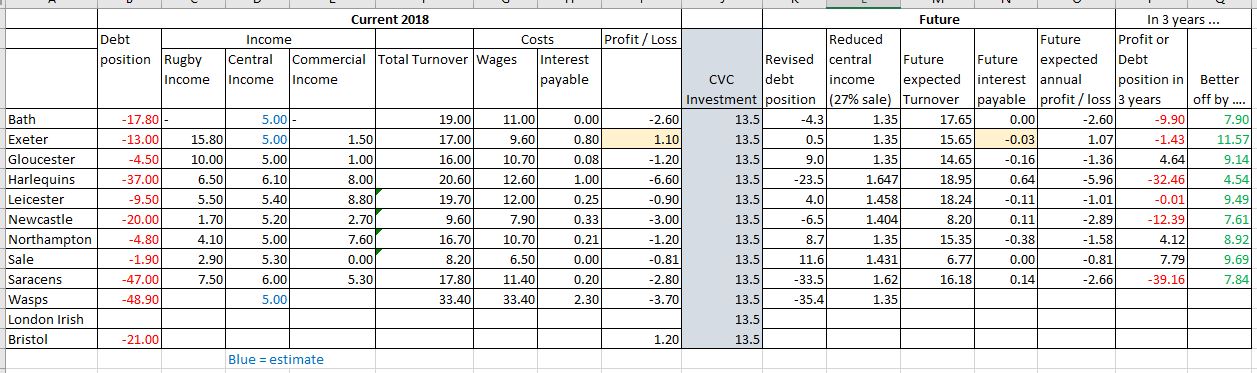

This is a post I made in the NH thread in September.

https://www.forum.thesilverfern.com/topic/1013/nh-club-rugby/996Looking at the latest premiership finances.

-

Back on the other thread I did an examination of some of the clubs positions based on a £17m upfront payment for 50% of PRL. I have done the same, keeping it at £17m payment but for 33% sale of PRL and a 33% reduction in central income.

Here is a crude examination of a cross-section of the clubs. Assuming no major changes in income (including non-rugby income) or reduction in wage costs,

Central Income In the next 5 years.

• RFU central payments unchanged

• Naming rights sponsorship unchanged

• TV rights unchanged for 3 years - then re-issueNewcastle. Borderline viable venture where current central funding makes up 50% of their turnover.

Borrowings/investment by owner: Loans owing £20m.

Expenses:

• Interest payable £332,529

• Wages £7.9m (10th highest, 81% of turnover)Turnover £9.7m

• Income from Premier Rugby, RFU and RFL £5.2m

• Match income £1.7m

• Commercial £2.7mCurrent Loss before tax £3m

£17m payment means:

- £20m debt can be reduced to £3m. Reducing their interest costs from 0.3m to 0.05m.

- Currently making a loss of £3m a year. After reducing their central income by £1.7m (from 5.2 to 3.4m) but also reducing their interest costs from 0.3m to 0.05 , this means they are losing £4.65 m per year.

So in 3.7 years time, Newcastle are back to square one and will have a £20m debt again. All this does is see them through to the next TV and sponsorship rights deals.

Gloucester: Reasonably well run MOTR club who own their own ground. Central funding represents 31% of their turnover.

Borrowings/investment by owner: Bank loan £4.5m

Costs:

• Interest 0.08m

• Wages; 10.7mTurnover £16m

• (Central income £5m)Loss before tax £1.2m

Don't have much debt - £4.5mGet a payment of £17m

- So, now have cash reserves of £12.5m

- Were losing £1.2m a year, will now lose £2.8m a year (current 1.2 loss + 1.7 reduced central funding – 0.01 reduced interest)

So in 3 years time when TV rights are up. Gloucester have wiped their debts, but lost £8.4m in the mean time. So are now £8.6m in the black after 3 years (out of that £17m) but still losing money hand over fist and those cash reserve would last just 3 more years before their borrowing again for operational costs.

Exeter. Well run club.

Borrowings/investment by owner: Debentures £8m; bank loan £5m.Costs:

• Interest 0.8m

• Wages; £9.6m (9th highest, 56% of turnover)Turnover £17m (6th highest in Premiership)

Profit before tax £1.1m

If receive payment of £17m.- Can pay off loan of £13m entirely, and have £4m cash reserves.

- Were making profit of £1.1m a year, will now make a profit of £0.2m a year (current 1.1m profit - 1.7 reduced central funding + 0.8 reduced interest).

So in 3 years time when TV rights are up. Exeter have wiped their debts, have £4m cash reserves, still profitable (just), but reduced profit to only £0.2m a year. However, as it is a member owned club, can assume the £4m cash reserve would be re-invested in the club in a way to increase future profits. Rather than taken out by the shareholders/owner.

Saracens: Highly leveraged play thing.

Borrowings/investment by owner: Owed to parent co. and shareholders £47mCosts:

• Interest 0.02m

• Wages: £11.4m (4th highest, 64% of turnover)

Turnover £17.8m (5th highest in Premiership)

Loss before tax £2.8mAgain, working on a payment of £17m

- Can reduce loan from £47m to £30m

- Were making a loss of £2.8m , this increases to £4.5m

So in 3 years time when TV rights are up. Saracens have reduced their debts by only £4.5m to £43.5m.

Their owner, to whom they pay negligible interest on their $43m debt will be aged 73 …..

Wasps: Highly leveraged gamble.

Borrowings/investment by owner: Inc £12.9m to owner £48.9mCosts:

• Interest 2.3m

• Wages: £17m (Highest, 51% of turnover)Turnover £33.4m (Highest in Premiership, includes Ricoh Arena turnover)

Loss before tax £3.7m

Again, working on a payment of £17m

- Can reduce loan from £49m to £32m

- Were making a loss of £3.7m , this increases to £5.4m

So in 3 years time when TV rights are up. Wasps will have debt of £48.2m. Not much change.

Wasps are a huge speculative play on the Ricoh Arena and the hotel they have built. Maybe a £17m injection of cash now will be enough to get by until the business is sustainable.

-

The reports of how much the CVC stake would be seems to vary - with some saying more than £200m, and others saying £240m to make it an even £20m per club.

Except, if I recall correctly, there are 13 clubs who own stakes in the PRL - London Irish being the odd one out this season - so they would get a shareout from the investment - making the range from £15m - £18m per club.

Lastly, the central payments from RFU were based on performance for the second half of the agreement (2020-2024) so it is likely that the amount from RFU would decrease given their annual report figures being down - the RFU flagged this some months ago.

"Steve Brown has also spoken about how England's clubs could be set to suffer a decline in revenue from their financial deal with the RFU if Twickenham's forecast of a possible downturn in profit proves accurate.

He revealed the Professional Game Agreement (PGA) that underpins England's access to players from the Gallagher Premiership promises a fixed payment of £112million for the first four years only.

For 2020-24 of the eight-year deal, the amount received by clubs is linked to financial performance at the RFU, with Brown overseeing a redundancy process that is expected to see 62 people lose their job by the end of August to help offset rising fixed costs against an outlook of plateauing or reduced profit.

"The good thing about the PGA which we put in as a safety net was that the income part of it becomes flexible after the first four years, move with our finances," Brown said.

"If our income goes down, so does the agreement payment. So the PGA doesn't cause us a problem forever, it's just within the next two years.

"The clubs are already aware of this. That has always been the case. I guess from the clubs' point of view they have looked at securing their revenues for four years. They are fully informed." -

@des-lexic said in Rugby Finances:

@rapido

Hi New guy here. That summary of the English clubs is superb.It is indeed. Well done. But I'm not reading it ...

-

@rocky-rockbottom said in Rugby Finances:

Any relation to the Pondents? Or the Picables?

those fuckers are Blues fans fella

-

@antipodean said in Rugby Finances:

Sam Burgess?

Another megabucks RL "superstar" who didn't make the grade. Not quite as crap a player as Farrell Snr, but pretty close.

-

More on the RFU finances issue. The in-fighting has begun...

Love the "Respect and teamwork are two of rugby’s prized core values". Someone should tell Owen Farrell.....

Former chief executive and chairman of RFU stripped of 'privileged membership' for 'lack of respect'

"Francis Baron, the former chief executive of the Rugby Football Union, and Graeme Cattermole, a former chairman, have been stripped of their complimentary tickets and hospitality at Twickenham Tests after publicly raising concerns about its financial position.

The pair have been accused of showing “a lack of respect” after they claimed the RFU was in a perilous state, having written two reports analysing its financial affairs, details of which were published in The Daily Telegraph.

The RFU annual report published on Monday showed the governing body had made an operating loss of £30.9 million for 2017-18, although it said that was offset by a cash injection of £31.6 million from the restructuring of a Twickenham hospitality business. Steve Brown, the RFU chief executive, announced on the eve of England’s autumn international against Japan that he would step down from his £400,000 post at the end of the year, with insiders claiming he had become weary of “sniping and rugby politics”.

A motion to strip Baron, who was chief executive for 12 years before retiring in 2010, and Cattermole, who stepped down as chairman of the board in 2004, was proposed at council meeting at Twickenham last Friday and passed with a majority. Baron was told about the decision on Saturday morning and the RFU said in a letter it would honour the tickets he had for England’s victory over Australia that day, but that his privilege membership would be removed for the Six Nations Championship onwards.

Privilege membership is awarded to a small number of people each year in recognition of outstanding contributions to the game, and Baron was one of handful of former paid staff to have been granted it.Benefits include: two complimentary match tickets for Test matches at Twickenham, with the option to purchase four additional match tickets; one complimentary lunch, with the right to purchase an additional lunch; access for two to the members’ lounge, including free drinks; a complimentary dinner ticket, with the option to purchase an additional dinner ticket.

Chris Kelly, RFU president, said the decision to withdraw their “privilege membership” of the union had been taken because of a “lack of respect” shown by Baron and Cattermole in their criticism of the governing body.

“Respect and teamwork are two of rugby’s prized core values. Council awards privilege membership to a small number of people who have given outstanding service to the game and embody its core values,” Kelly said.

“At Friday’s Council meeting, members voted by an overwhelming majority to withdraw privilege membership from Francis Baron and Graeme Cattermole due to the clear lack of respect they have shown to the Union, our members and our staff.”

-

@victor-meldrew said in Rugby Finances:

More on the RFU finances issue. The in-fighting has begun...

Love the "Respect and teamwork are two of rugby’s prized core values". Someone should tell Owen Farrell.....

Any particular reason why? He's not renowned for lack of either.

-

Already on the NH Club Rugby thread.

Only Exeter in the black as Premiership Rugby racks up £50m in losses

• Twelve of the 13 clubs record increased deficitsAlthough this reporting is for the year to June 2018. To put in some perspective - A collective £50m in losses this year is already equal to a quarter of the incoming CVC investment. They're starting from further back than I thought.

Here's a crappy spreadhseet I put together last year when trying to work out where the CVC investment would put the clubs based on the 2016/17 accounts from an earlier Guardian article from earlier in the thread. ( https://www.theguardian.com/sport/2018/aug/28/premiership-finances-the-full-club-by-club-breakdown-and-verdict )

But to be honest, I struggled to place how the reduced interest payments for the well run clubs would offset the reduced central payments. From the numbers supplied in the Guardian article.

So have ignored interest costs in the future for simplicity, as some aren't paying interest anyway on the sugar daddy loans.

This is also ignores potential increases in revenue. It is just to demonstrate how quickly the CVC money will get hoovered up (or Dysoned up in Bath) under the status quo.

Anyway, I'll link it anyway.

-

New Harlequins stadium, Northampton signings - what EVERY Premiership club need to buy

KERR-CHING. English club rugby is suddenly awash with cash.

By NEIL SQUIRES

PUBLISHED: 18:00, Mon, Apr 8, 2019

The long-awaited deposit of £13m from private equity investors CVC has finally landed in the bank accounts of all 12 top-flight English clubs and Championship leaders London Irish, as the 13th shareholder in Premiership Rugby.

It is effectively tomorrow’s money from TV and sponsorship deals today – income in future seasons will drop unless CVC, who now own a 27 per cent stake in Premiership Rugby, can leverage significant increases in marketing revenue.

This means it should be guarded carefully and used sparingly.

For more than 20 years the clubs have talked of balancing their books and turning the domestic game into a profitable enterprise only to overspend every season.

Despite record income levels, the Premiership is lose around £30m per year.

Bath were the most recent club to return their figures last week. ‘Bath Rugby reports a year of revenue growth and increased investment,’ trumpeted Premiership Rugby.

They reported a £3.1m loss after tax, up from £2.5m the previous year.

The clubs just can’t resist the temptation - the cash will be splashed. But what on? Each one has a different priority.

Bath – Bricks and mortar. The long-running saga over a home to match Bath’s heritage goes on with the latest version an 18,000-capacity stadium on The Rec the dream for the 2021/22 season. They don’t come cheap - £60m is the estimate - but they will still probably sign a world-class stand-off while they’re at it with former All Black Aaron Cruden one of several linked with the club.

Bristol - Gareth Anscombe. The Wales stand-off has been offered £500,000 to turn his back on Test rugby after the World Cup and join the club. Nathan Hughes and Dave Attwood are also on his way to the free spenders who already have the highest-paid player in the Premiership, Charles Piutau, who is on £950,000 per year.

Exeter – Rob Baxter. The Chiefs director of rugby is a frontrunner to replace Eddie Jones as England coach if, as expected, he leaves after the World Cup and if he took the job and moved his coaching staff with him to Twickenham it would rip the heart out of the club. Buy him Devon. Stuart Hogg is also on his way.

Harlequins – A new Stoop. Quins have plans in place to upgrade their current 14,800-capacity home into a 25,000 stadium with an artificial pitch at a cost of around £50m. Had a stab at prising Beauden Barrett away from the All Blacks only to miss out but have Argentina scrum-half Martin Landajo on the way.

Gloucester – Danny Cipriani. The stand-off has made such a difference to Gloucester since his arrival at the start of the season that the club’s success in talking him into signing an enhanced three-year deal last week could be the trigger for big things.

Leicester – Year-round players. It’s all very well splashing out to keeping Manu Tuilagi and the Tigers’ other England internationals but if they are half the side when they’re missing they are vulnerable as this nightmare season has shown. Jordan Taufua from the Crusaders and Pumas forward Thomas Lavanini are on the way.

Newcastle – Spending up to the salary cap. Holding onto their own players, never mind signing others is a challenge with the smallest budget in the league. Kingston Park could also do with a few quid spent on it.

Northampton – New Zealanders. Kiwi director of rugby Chris Boyd has All Blacks rock Owen Franks on the way from the Crusaders plus Matt Proctor from the Hurricanes. They are unlikely to be the last from that part of the world.

Sale – South Africans. Steve Diamond may have missed out on the ginger ninja Steven Kitshoff but Akker van der Merwe and the du Preez brothers are on their way to join Faf de Klerk and Rohan Janse van Rensburg at the AJ Bell Stadium.

Saracens – The best accountants around. They are needed to somehow keep the champions within the salary cap with yet another England international, Elliot Daly, coming on board next season.

Wasps – Plug for the club’s financial black hole. They lost an eye-watering £9.7m last year and some of their biggest names, including Willie le Roux, will leave at the end of the season. They still need to pay the salary of the incoming Malakai Fekitoa from Toulon though.

Worcester – Reputation reshape. Annual relegation struggle makes Sixways unattractive for signings so cash injection will help on that front and enable the Warriors to keep their promising youngsters like Ted Hill.

-

-

Changes in debt position. For those clubs who's pofit or loss was mentioned in the article (https://www.theguardian.com/sport/2019/apr/08/exeter-in-the-black-premiership-rugby-losses-year-to-june-2018)

-

Saracens will be further investigated by Premiership Rugby for a potential breach of salary cap regulations relating to the club’s co-investment arrangements with a number of their high-profile players.

Premiership Rugby said on Wednesday night that Saracens had not disclosed details of all of their arrangements when they were first reported in March. The arrangements involve the Saracens owner, Nigel Wray, sharing businesses with players such as Owen Farrell, Maro Itoje and Mako and Billy Vunipola, as well as co-owning houses with former players.

Saracens issued a swift response, blaming a “minor internal oversight” but Premiership Rugby will continue its review into the current champions. All clubs must adhere to the £7m salary cap – which does not include two marquee players – with punishments ranging from potential fines to points deductions.

Saracens have previously insisted that they have disclosed all of their investments with players, with Wray insisting last month that “we proactively disclose co-investments when they occur, even though we are under no obligation to do so”. But on Wednesday Premiership Rugby insisted that “clubs are required to supply information to the Premiership Rugby salary cap manager on any arrangements between a connected party and a player which might constitute payment or benefit in kind”.

Wray has staunchly defended his business ventures with his players and last month issued a lengthy statement, again insisting that his co-investments are not part of Premiership’s salary regulations. “I recognise that in some quarters, these co-investments are perceived as part of the Premiership salary regulations,” he said. “They are not. Investment is not salary.”

Saracens’ statement on Wednesday was similarly insistent. “Whilst co-investments are not part of the salary regulations, we disclosed these transactions in good faith and indeed divulged more information than was necessary. We remain confident that we comply with the salary regulations and will continue to support the entrepreneurial spirit and future of our players.”

Premiership Rugby’s statement, however, comes just 24 hours after its first board meeting since Wray’s arrangements with his players came to light. The statement continued: “The information now received from the club and various parties will be reviewed. Premiership Rugby will make no further comment at this stage.”