Rugby Finances

-

at the other end of the scale...

from February.

Running both the semi-professional magpies, and being responsible for amateur club rugby and youth rep rugby etc. A NZ provincial union has to be more responsible. (except Otago ....)

https://www.nzherald.co.nz/hawkes-bay-today/sport/news/article.cfm?c_id=1503460&objectid=12207610

Rugby: Union in black for 20th consecutive year

Embarking on an expense-cutting mission saw the Hawke's Bay Rugby Union post a surplus in excess of $100,000 last year.

Details of the 20th consecutive surplus were revealed at tonight's 134th annual meeting in Napier attended by 63 people.

Speaking before the meeting, union chief executive Jay Campbell said the $109,934 surplus recorded during the financial year ending on November 30 was $99,168 more than budgeted for.

"We didn't replace staff during a period last year. We've just started doing that during the last three months." Campbell pointed out the union didn't have a commercial manager for six months and he combined that role with his job until Dan Somerville returned to the union.

Total revenue dropped by $121,671 to $4,142,488.

Campbell said a key factor in this drop was Israel Dagg missing out on the All Blacks.

"We get extra money from the New Zealand union if any of our players make the All Blacks Championship squad."

However, for the third consecutive year the union's equity was more than $1 million — $1,277,426 to be precise, an increase of $107,934 on last year.

The New Zealand Rugby Union's grant dropped by $38,612 to $1,592,131.

Total expenses for the union dropped $211,924 to $4,019,037.

Expenses for the Magpies amounted to $1,772,577 which was $19,724 less than the previous year.

-

and now some bad provincial news ...

One of New Zealand's proudest rugby unions is in danger of financial ruin.

Taranaki posted a loss of just under NZ$1million last year, primarily due to the limited use of their New Plymouth home ground Yarrow Stadium.

The pain is real for the union's top side and its quest to stay competitive, particularly for a union that boasts a proud history in provincial rugby.

A maiden national provincial title in 2014 and six successful Ranfurly Shield tenures - the most recent two years ago

Taranaki's given New Zealand rugby names like Barrett, Crowley and Loveridge, but now the outlook is bleak, mostly because they can't fully utilise their home ground.

Yarrow Stadium's two main grandstands are considered an earthquake risk.

"We've had to strip out a lot of costs of Taranaki Rugby across all departments," said chief executive Jeremy Parkinson.

"The biggest focus being on the Mitre 10 Cup, one the team and two the management."

Effectively - the union's ability to attract and then keep players is severely limited.

Currently, they can't sign players for more than a year. Their squad is full of talent on limited paying deals.

"The reality is we now have minimum contracts for our players," Parkinson said.

On top of that they can only afford one full-time support staff member- that's head coach Willie Rickards.

"Previously, with a fully functioning Yarrow Stadium, we've had the ability to go out and recruit at a high level; whereas that's not the case now," said Parkinson.

The situation is personal for first five Stephen Perofeta. The Blues and Taranaki playmaker said he owes a lot to the amber and blacks.

"The Naki gave me an opportunity to come straight out of school into a welcoming environment where I was able to grow, not only in rugby but as a person," he said.

Yarrow Stadium's future is now at a public consultation phase, but the Taranaki regional council wants an NZ$55million upgrade of both stands.

"We have really good staff and really passionate supporters, so we're calling on them this year to get behind us," said Parkinson.

The Taranaki Rugby Union desperately need help to end their troubles.

Newshub.

-

jesus that's rough. Is it a case of changed standards? or the initial design not up to scratch?

That is a shit ton of money for anybody to come up with, let alone a provincial rugby union.

stadiums are such a massive risk.

-

@Machpants said in Rugby Finances:

Goota feel sorry for them, 'oh here's a 55 million present for you, a MINUS 55 million one'

The Taranaki RFU don't own it though. Maybe they did own it back in the distant past when it was Rugby Park. But generally in the 90's & 2000's these old provincial rugby grounds passed into council hands when came time to upgrade them to modern standards. E.g. the Hamilton Rugby Park to Waikato Stadium model.

Yarrow Stadium is owned by the Taranaki Stadium Trust. It is operated by the New Plymouth District Council.

The Taranaki Stadium Trust - which is controlled by the Taranaki Regional Council -- took over ownership of the stadium from the New Plymouth District Council in 2014.

https://www.stuff.co.nz/national/108035138/taranakis-yarrow-stadium-owner-incurs-157m-annual-loss

-

Here's an interesting example of a traditional rugby ground bouncing backwards and forwards between rugby union and council ownership.

Fraser Park in Timaru.

From June 2016:

https://www.stuff.co.nz/timaru-herald/sport/80947955/south-canterbury-rugby-gets-sole-ownership-of-alpine-energy-stadiumThe South Canterbury Rugby Union is set to become the sole owner of Alpine Energy Stadium after reaching terms with the Timaru District Council.

The Fraser Park Trust announced the agreement for the transfer on Friday.

Trust chairman and Timaru councillor Tony Brien said it was an important day for rugby in South Canterbury.

"The Timaru District Council came to the rescue of Fraser Park in 1989 when the financial downturn put the union, along with many other organisations, under pressure".

The 1989 rescue package involved the creation of the Fraser Park Trust and a $240,000 contribution by the council.

SCRU chairman Ray Teahen said he was delighted with the outcome.

"This has been a complex process where we have all had to be mindful of the historical situation, the responsibility of the TDC to ratepayers and other sports organisations, and the responsibility of the union to the 2,500 rugby players and their clubs in South Canterbury.

"The union is financially stable with a strong balance sheet and able to take up the responsibility for a large and valuable community asset."

The agreement sees the assets transferred into a new trust to be called the Fraser Park Community Trust and the original council contribution converted to a new 15 year loan secured by a mortgage over the stadium.

As the rugby union undertakes a number of capital developments to the stadium the value of these developments will be written off against the loan.

The write off will be deemed to be the TDC's contribution to capital developments, although they will be funded from union reserves.

No firm decisions have been made on what those capital developments will be.

Brien said the approach complies with council policy by ensuring that council funds are applied to going development and modernisation of sports facilities in Timaru.

Teahen said the union will begin a process of evaluating the facilities and what will be the best investments for the future development of the stadium.

"These decisions will involve wide consultation with the rugby community and may include an upgrade of the playing surfaces, upgraded safety arrangements between vehicles and pedestrians, dedicated changing and shower facilities for women and girls' teams, and referees' facilities."

"We are all excited by the possibilities in front of us and the union would especially like to express its appreciation for the support the Timaru District Council has given to the Fraser Park Trust over many years and for the encouragement to us to make this community facility something Timaru can be proud of in to the future."

The stand-off between the council and union started in January last year over the council's vested interest.

The union wanted to upgrade Alpine Energy Stadium's facilities and unwind the trust which owned the stadium. They believed there was little benefit in the trust structure, while the extra layer of ownership was restrictive to development.

The trust's founding document was however somewhat sketchy and no repayment details had been mentioned or had ever been made.

The point of contention was around whether the money given to the union over 20 years ago was in fact a council loan or a grant, but that has been resolved to both parties satisfaction.

The 3.7493ha stadium has a capital rateable value of $2,120,000 of which $510,000 is land value.

-

and on that subject of the SCRFU and Fraser Park.

Here is a recent update. Good news.

South Canterbury Rugby's redevelopment plans for Alpine Energy Stadium get $500k boost

-

Not strictly a "rugby finance" article. But is a good read. About Forsyth Barr Stadium.

From Saturday, 16 February 2019

It is 10 years since a major vote in Dunedin’s Municipal Chambers gave the green light for the Forsyth Barr Stadium. The venue has been racking up successes attracting concerts recently, but the bitter debate at its inception come at both a financial and emotional cost to the city. David Loughrey speaks to those involved.

-

Thursday, 4 October 2018

'Stellar year' sees stadium manager in the black, again

The company running Forsyth Barr Stadium has delivered its third consecutive profit, and the man in charge hopes the days of losses are behind it.

Dunedin Venues' annual report for 2017-18 showed the company made a $602,000 after-tax profit in the year to June 30, up from $299,000 the previous year.

Dunedin Venues chief executive Terry Davies said the ''stellar year'' reflected the string of significant events staged at the stadium during the period.

That included an All Blacks Bledisloe Cup test match, but also concerts by Stevie Nicks and The Pretenders, Roger Waters, Robbie Williams and three massive shows by Ed Sheeran.

The success of those events was reflected in visitor statistics, which showed more people (263,000) attended music concerts at the stadium than Highlanders or All Blacks rugby fixtures (133,700) during the period.

Mr Davies said that showed the venue's success in diversifying its business in recent years, which also reduced the financial risk to ratepayers should it miss out on any one event, like an All Blacks test.

''You'd never have dreamt those sorts of numbers coming through for concerts four years ago. It was always rugby-dominated. It shows a shift in the business.

''We need to sustain that. We want that to be the model.''

The profit was a ''good result'' that would be reinvested into the business, covering maintenance and improvements and allowing it to grow, he said.

''We're not sitting on our hands. We're looking to improve our business all the time.

''We need to deliver surpluses to get to where we want to be.''

Rugby remained an important part of the stadium mix, but the venue still needed to be used more, and draw bigger crowds more often, he said.

''We've still got a way to go yet.''

Despite that, he was confident the days of the company's deficits were over.

''There's no way we would do that.

Putting all your eggs in one basket is high-risk, and we're trying to spread that risk.''

Having concerts by Stevie Nicks and The Pretenders, Roger Waters, Robbie Williams and three shows by Ed Sheeran all in one financial year, is quite amazing. (plus a Bledisloe Cup test match)

-

Although Dunedin rate payers are still paying the borrowing costs to build the stadium, with no dividends yet from the stadium profits. The stadium oerating profits (and the buidings depecraiaction tax write offs) are mixed up in Dunedin City Holdings Ltd. The stadium was planned in 2011 to deliver an $8m annual dividen to the council.

Council-owned companies such as Dunedin Venues paid an annual dividend to their parent body, Dunedin City Holdings Ltd, which in turn should make dividend and interest payments to its shareholder, the council.

Since 2011 DCHL's total annual payment had dropped from $23.2 million a year to $11.152 million in 2015-16, when dividends ceased completely. (But this has much to do with rotting power poles, as sports facilities)

Although "In the meantime, DCHL would continue to make interest payments to the council worth $5.9 million a year."

Dunedin City Holdings Ltd owns:

- Aurora (Electricity Lines Company)

- Delta (Electricity Lines Company)

- Dunedin Venues Ltd

- Dunedin Stadium Property Ltd

- Dunedin Railways Ltd - formerly Taieri Gorge Railway Ltd

- Dunedin Airport

- City Forests

from: https://www.odt.co.nz/news/dunedin/dchl-group-posts-profit

Thursday, 1 March 2018the previous year, and of $2.169 million for Dunedin Airport, up from $1.72 million the previous year.

Aurora and Delta's six-month results both dipped slightly from the corresponding period last year, following the separation of the two companies' boards, staffing and management structures.

Delta's after-tax surplus was $1.67 million, down from $1.84 million, while Aurora's was $3.15 million, down from $4.03 million.

Dunedin Venues Ltd, the company running Forsyth Barr Stadium, recorded a small but improving six-month after-tax profit of $298,000, up from $77,000 for the same period the previous year.

Dunedin Railways Ltd - formerly Taieri Gorge Railway Ltd - recorded a worse-than-expected after-tax loss of $634,000, up from the previous year's six-month $470,000 loss.

That was due in part to last year's July storm, which cost the company $385,000 in track repairs and $175,000 in lost income.

Dunedin Stadium Property Ltd - formerly Dunedin Venues Ltd, which owns the stadium building - posted a six-month loss of $4.2 million, as expected, up from $3.2 million. That largely comprised a non-cash book loss of $3.5 million a year, representing depreciation, staff said.

DCHL chairman Graham Crombie said he was pleased with the ''positive financial result once again''.

''Our half-year result is in line with our budget projections and our continued strong operating cash flow will provide a stable basis for the coming months and years.''

City Forests' result was primarily driven by strong international and domestic markets, and favourable shipping costs, while Dunedin Airport enjoyed an increase in landing charges and passenger numbers.

Aurora's increasing investment in its network maintenance showed in its capital expenditure, up nearly $16 million to $38.07 million, and higher group debt, while Delta's revenue was down largely due to the new contracting arrangements between it and Aurora.

-

Westpac Stadiums most recent financial report.

https://www.westpacstadium.co.nz/fileadmin/images/content/WRST_AR18.pdf

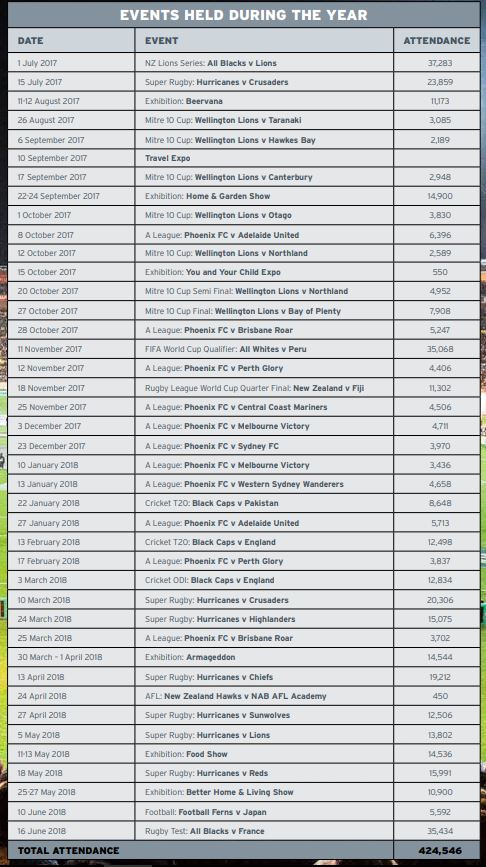

Westpac Stadium hosted a total of 50 major event days for the year, plus

several community event days. Over 424,000 fans attended events during the

12 months, with the cumulative attendance since opening now at 9.73 million.

To keep it rugby related. Rugby attendance was 51% (217,243 out of the 424,546). Which was an exceptional year with 2 All Back tests falling within the FY.

-

still on the caketin report.

FINANCIAL PERFORMANCE

Our net surplus for the year was $1.3 million compared to $1.7 million in 2017.

Event revenues were $7.8 million compared to $6.9 million in the previous

year and a budget of $6.9 million.

Our budgeted surplus for the year was $2.6 million, which included grant

income from the Wellington City Council of $1.75 million. This is part of a $5

million contribution toward the concourse upgrade currently underway, which

is payable as work progresses. The amount received in the June 18 financial

year was $0.33 million. The balance will be received in future years. Excluding

this grant income, the net surplus was $0.94m, slightly ahead of the budget

of $0.85 million.

Both the Caketin and Forsythh Barr I would classify as succesful stadium builds that have come in at a level that debt burden is manageable (In Caketin's case has been getting repaid at a good level).

Caketin: The Stadium cost $130 million to build. The finance came from:

Wellington Regional Council: 25$M

Wellington City Council: 15$M

Grants and Donations: 7$M

Fundraising: 50$M

Bank Loan: 33$MThe bank loan is now just $2.5m

I just can't believe the Christchurch stadium plan. I won't recommend the Caketin model, I'd say aim a bit higher with a covered rectangular stadium. Why any council isn't trying to copy Dunedin as close as possible (without the bitter politics ...) is beyond me.

-

The Christchurch plan, options.

I recommend clicking the link above.

from the article:

-

Option 1 is a stadium with covered seats only, estimated to cost about $385m

-

Option 2 is a stadium with a transparent ETFE plastic roof similar to that at Dunedin's Forsyth Barr stadium, estimated to cost about $470m

-

Option 3 is a stadium with a solid roof, concrete floor and retractable turf (so grass could grow outside), estimated to cost about $561m.

Forsyth Barr cost $224.4m

I say chose option 2.

-

-

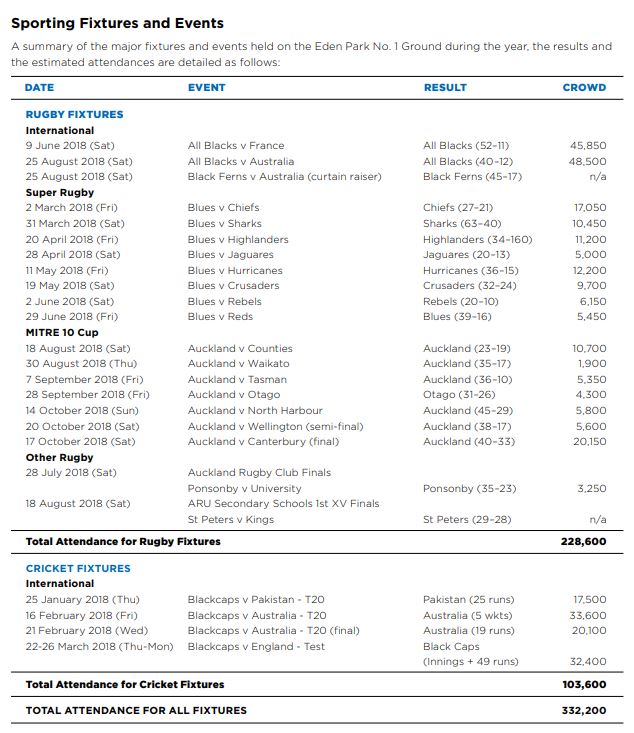

Eden Park's most recent report (a year ahead of the Caketin's above).

https://www.edenpark.co.nz/uploads/images/Eden Park Annual Report 2018.pdf

Big concern here is (2018):

- Sports Events Income 5,804,000

- Sports Events Expenses 7,733,000

An even in 2017 (Lion year), just a small sports event profit:

- Sports Events Income 8,646, 000

- Sports Events Expenses 7,509,000

Need to increase those paltry Blues and Auckland NPC crowds.

-

From the FT.

I'd guess Wasps will get a fine.

Wasps rugby club faces FCA probe over market statements

Formal investigation into Premiership team’s overstated earnings

Caroline Binham in London 9 MINUTES AGO

Rugby club Wasps is being investigated by the UK’s financial regulator over whether it misled the market about the state of its finances and how quickly it rectified the matter.The Financial Conduct Authority’s scrutiny comes after the 152-year old Premiership club admitted to creditors in late 2017 that it had overstated its earnings, breaching covenants on a £35m retail bond, and its auditors, PwC, stepped down after finding “falsified” information.

A £1.1m capital injection by Derek Richardson, the Irish businessman who owns Wasps and is its chairman, was wrongly stated as income. According to a market announcement made in December 2017, this cut the club’s earnings to £2.4m rather than the £3.5m it first stated.

Proceeds of Wasps’ bond, which is traded on the London Stock Exchange, go partly towards developing the club’s Ricoh stadium in Coventry and refinancing debts. The accuracy and timeliness of statements to the markets made by Wasps’ special purpose vehicle, the issuer of the bonds, are overseen by the FCA.

The watchdog has opened a formal investigation and is summoning individuals for interviews, said people familiar with the situation. The FCA has the power to fine and criminally prosecute breaches of its market-cleanliness rules.

-

Quite a fascinating back story to how Wasps ended up with the opportunity of owning the Ricoh Arena.

I didn't know that the Coventry City owners had plumbed such depths of shithousery, I just assumed they were a typical yo-yo club that had over-extended themselves into financial ruin.

Heartwarming story of a Hedge Fund attempting to pay hard ball but fucking up big time.

-

Coventry City, even though in the third tier these days - still average 10-12,000 over 22 home league games, plus cup ties.

Wasps wouldn't be wanting to lose a tenant like that.

Although they wouldn't mind losing a tenant that is constantly sueing them .....However, Coventry City also don't want to be risking getting thrown out of the Football League for being homeless.

https://www.bbc.com/sport/football/43979047

Now that Coventry City owners have lost their court battle, Wasps say they are open to talks

https://www.bbc.com/sport/football/47951057

Wasps have opened the door to the idea of talking again to the Sky Blues.

The rugby club, City's landlords, have always said they would be ready to discuss a new deal once the legal action ended.

-

Wales and Scotland made to wait in World Cup player release row

• Premiership and World Rugby could agree deal next month

• Dispute centres around insurance for non-English players

Gerard Meagher

Thu 25 Apr 2019 19.48 BST Last modified on Thu 25 Apr 2019 23.07 BST

Wales and Scotland are among a number of nations who will not find out until next month if their World Cup preparations will be severely disrupted by being denied early access to their Premiership-based players.

Warren Gatland names Wales’s World Cup training squad next Tuesday but the Guardian understands it will not be clear whether players such as Liam Williams, Dan Biggar and Taulupe Faletau are available for their altitude training camp in July, and their first warm-up match against England on 11 August, until World Rugby’s council meeting on 22 May.

As revealed by the Guardian last December, Premiership Rugby (PRL) issued World Rugby with a threat of legal action over an insurance row and had vowed to strictly enforce regulations over the release of non-English players in the top flight as a result.

That would mean Williams, Biggar and Faletau as well as a raft of Scotland internationals in the Premiership cannot join their countries’ World Cup preparations until mid‑August, only 35 days before the tournament begins in Japan. Tonga, Samoa and Fiji would also have their preparations hampered.

The Guardian understands that PRL and World Rugby are close to an agreement and that a proposal is due for consideration at the global governing body’s council meeting next month.

But while there is a degree of confidence from both parties it will be signed off, there is still some way to go before the agreement is finalised.

“We are continuing to have discussions with World Rugby and while we have made progress there are still some outstanding issues,” a PRL spokesperson told the Guardian. “Positive discussions are ongoing, however there are still some details that need confirming. We cannot confirm these finer details at this stage but we look forward to further positive discussions with World Rugby.”

The Breakdown: sign up and get our weekly rugby union email.

The initial dispute centred on World Rugby’s regulation 23, which states clubs are compensated by unions for injuries picked up on international duty for players who earn £225,000 or less a year. Anything more than that is paid by the clubs.

World Rugby had agreed to increase the threshold to £350,000 but PRL wanted no limit and requested it be removed on the basis there are 60 non-English internationals in the Premiership earning £225,000 or above and 25 on £350,000 or above. That was rejected last year, as was another request to do away with the 12-month limit, which means clubs are liable for any injury longer than a year.

The impasse – which led to that threat of legal action last December – prompted PRL to take a stance that no non-English Premiership players would be available for selection by their countries until the official pre‑World Cup window opens. According to World Rugby’s regulation 9, PRL must release players when it does open but does not have to before. If World Rugby ratifies the new proposal next month, however, those players are set to become available to their countries much earlier.

Wasps rugby club faces FCA probe over market statements

Wasps rugby club faces FCA probe over market statements