Rugby Finances

-

@Rapido said in Rugby Finances:

Wow. Maybe they did get the 14million just for the one club.

Revealed: Premiership clubs took £124m in taxpayer cash

Exclusive: The average each Premiership club received in the coronavirus-induced Winter Survival Package loans is nearly £10m

The amount of taxpayers’ money poured into Premiership Rugby clubs to stop them going bust has more than doubled initial estimates to reach £124 million, the Sunday Telegraph can reveal.

The true scale of the financial crisis to have engulfed the professional game since the coronavirus pandemic can be laid bare in the week this newspaper disclosed Worcester Warriors had been hit with a winding up petition by HM Revenue & Customs and Wasps were also being pursued over unpaid tax.

It was originally calculated that the Government’s Covid-19 Sports Winter Survival Package would allocate £59m to Premiership clubs when the initiative was announced back in November 2020 as part of a sector-wide bailout for those starved of vital ticket revenue during various lockdowns.

Four months later, though, that figure had rocketed to £88m following detailed submissions from clubs chronicling their estimated losses. The department for digital, culture, media and sport tailored packages to meet the financial circumstances of individuals organisations, providing loans to give them the best possible chance of survival in the short term. Rugby union was comfortably the biggest beneficiary of this scheme among professional sports.

It has now emerged that has subsequently surged again by more than 40 per cent to an average of almost £10m for each of the 13 Premiership teams for what are 20-plus year loans they will soon need to begin paying back. Premiership Rugby have declined to comment.

In November 2020, as Premiership fixtures were being played out behind closed doors to obliterate vital income streams, the initial estimate of £59m was labelled as a “much-needed lifeline for our clubs” by Darren Childs, who stepped down from his post as the league’s chief executive the following April and has since been replaced by Simon Massie-Taylor.

In a statement earlier this week Worcester maintained they are working on "solutions to secure the financial future of Worcester Warriors and to pay outstanding tax owed to HMRC.

Advertisement

“A solution, which would secure the long-term future of the club, has been approved. Unfortunately, there have been unavoidable delays beyond the club’s control to the final tasks required to complete the funding.

“Having kept HMRC fully apprised of the situation, we are disappointed that they have taken the decision to issue a winding-up petition.”

A spokesperson for Wasps said: “In common with a huge number of businesses, we agreed a time to pay arrangement with HMRC on coming out of the Covid-19 lockdowns. We have a strong relationship with HMRC and will continue to engage in proactive discussions with them.”

Imagine what our SR teams could do with 10 million squid!

-

https://www.bbc.com/sport/rugby-union/62630861

Some of the more interesting parts of the article:

Like all sports clubs, Warriors suffered during the coronavirus pandemic - and the DCMS have confirmed that the club benefited from an undisclosed-sized loan through Sport England, as part of the government's sports survival package (SSP).

Unpaid tax could be £6m

BBC Hereford & Worcester's James Pearson

After a weekend of rumours and speculation, it's widely expected the club will be put into administration this week, possibly as early as Monday.

On Tuesday, 16 August the company running Warriors' operations - WRFC Trading Limited - was handed a winding-up petition by HMRC.

While the company's accounts for 2020 show it had yet to pay £2.3m in taxes, its 2021 accounts are now overdue. The current figure for unpaid tax has been reported by some newspapers as being as high as £6m.

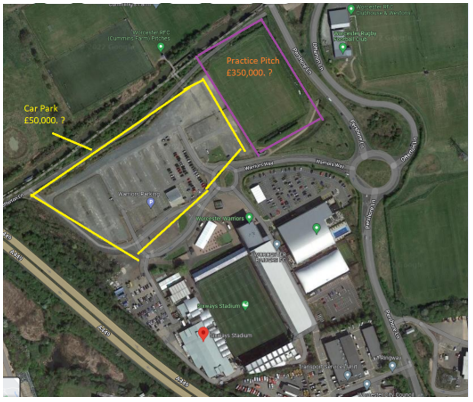

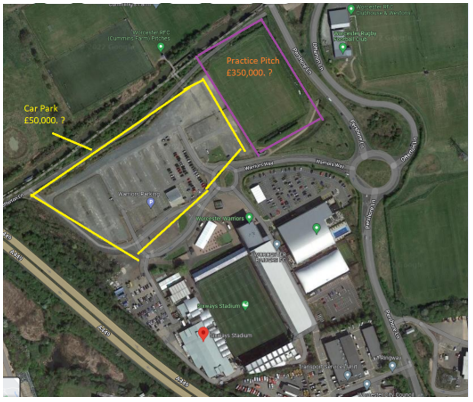

The day after Warriors were hit by legal action for unpaid taxes, the directors used another of their companies to purchase the club's car park, for just £50,000.

As well as being directors of WRFC Trading Limited, Colin Goldring and Jason Whittingham are also directors of a number of other companies, including Mq Property Ltd.

On Wednesday, 17 August Mq Property Ltd completed the purchase of the freehold of the club's car park. This was paid for with a loan from another company, Triangle Estate & Petroleum Ltd.

Separately in June, training pitches owned and used by Warriors were sold to a newly-created real estate company, Worcester Capital Investments Ltd, for £350,000.

The car park and pitches are sizeable parts of the Sixways site.

Warriors' accounts for 2020 state that as a whole the site had been independently valued at £16.7m. That estimate includes Sixways stadium; the freehold of which also now belongs to Mq Property Ltd.

Unlike indebted WRFC Trading Ltd, Mq Property Ltd is not known to face a winding-up petition, yet it now owns the bulk of the land the club sits on.

It's unclear whether the £50,000 purchase of the car park was an undervaluation. Its value - and that of the training pitches - will depend on what restrictions are in place on the land, as well as how easy it is to develop.

Warriors' 2020 accounts describe how the planning potential for the Sixways site had been 'significantly improved'.

In recent months Goldring and Whittingham have also set up three other new companies, Sixways Medical Limited, Sixways Property Limited and Sixways Stadium Limited. They have not revealed the purpose of these firms.

-

@Rapido said in Rugby Finances:

The car park and pitches are sizeable parts of the Sixways site.

My guesses .... these parts. 'Worth' £0.4m out of the independently valued full site valued at £16.7m.

I wonder if they also own the neighbouring grounds that the amateur Worcester RFC clubhouse and 4 rugby fields are located on?

-

@Rapido said in Rugby Finances:

@Rapido said in Rugby Finances:

The car park and pitches are sizeable parts of the Sixways site.

My guesses .... these parts. 'Worth' £0.4m out of the independently valued full site valued at £16.7m.

I wonder if they also own the neighbouring grounds that the amateur Worcester RFC clubhouse and 4 rugby fields are located on?

So some dodgy deals with the shareholders or something? No wonder they are going under, selling all that for 50k, FFS

-

^^ The desire to lose lots of money* each year is seemingly still instatiable.

(* write off tax, but in a fun way)

So, on that limited information - could extrapolate/guesstimate that debt position out to at least £41m in debt now, of which £20m would be owed to the British taxpayer (if rumours are true).

-

This is a pretty good article by Chris Jones.

Despite the headline, which is attention grabbing, but only one sentence out of the whole article. A good insight into the Premiership scene.Interview with outgoing Harlequins CEO , incoming Drua CEO - Mark Evans. Who has also formerly been CEO of Melbourne Storm and Western Force, and a director of rugby at Saracens.

-

@Rapido said in Rugby Finances:

Each club, it is believed, has taken on an eight-figure loan from the government. Worcester’s was £15m.

key point

If any bean counters had enough time on their hands to trawl through the individual accounts of the respective companies, they would discover that the cumulative losses of Premiership clubs in those first 25 years stand at more than half a billion pounds. For the most part, those losses have been covered by wealthy benefactors with great reserves of patience (if only they were infinite) and greater or lesser reserves of cash.

-

So ... this is good for NZ Rugby right? Reduces the attractiveness of offshore work if the pay isn't there. Rebalances the NZ lifestyle and opportunity to become an All Black?

Or do we just replace England with France/Japan destinations and still bleed coaching and playing talent offshore.

Anyone up with the play on this?

-

@nzzp said in Rugby Finances:

So ... this is good for NZ Rugby right? Reduces the attractiveness of offshore work if the pay isn't there. Rebalances the NZ lifestyle and opportunity to become an All Black?

Or do we just replace England with France/Japan destinations and still bleed coaching and playing talent offshore.

Anyone up with the play on this?

I think everywhere is in too much of a post-covid flux to be able to tell. Except France / Top14 seems as strong as ever, if not stronger.

Worcester were never a big player anyway, talking Melani Nanai level recruiters.

Where as Wasps, the next shakiest and have cut their cloth a bit, were recruiting at the Piutau, Shields, Sopoaga level.

-

A bit more about wasps, that's a lot of moolah

https://www.bbc.com/news/uk-england-coventry-warwickshire-62795446?at_medium=RSS&at_campaign=KARANGA

-

@Nepia said in Rugby Finances:

@Rapido I thought NH rugby was supposed to be in rude health, but it appears it's built on a house of cards?

English rugby most certainly is, never been good financially. France is a different kettle of fish though, massive money there

-

@Rapido said in Rugby Finances:

https://www.bbc.com/sport/rugby-union/62630861

Some of the more interesting parts of the article:

Like all sports clubs, Warriors suffered during the coronavirus pandemic - and the DCMS have confirmed that the club benefited from an undisclosed-sized loan through Sport England, as part of the government's sports survival package (SSP).

Unpaid tax could be £6m

BBC Hereford & Worcester's James Pearson

After a weekend of rumours and speculation, it's widely expected the club will be put into administration this week, possibly as early as Monday.

On Tuesday, 16 August the company running Warriors' operations - WRFC Trading Limited - was handed a winding-up petition by HMRC.

While the company's accounts for 2020 show it had yet to pay £2.3m in taxes, its 2021 accounts are now overdue. The current figure for unpaid tax has been reported by some newspapers as being as high as £6m.

The day after Warriors were hit by legal action for unpaid taxes, the directors used another of their companies to purchase the club's car park, for just £50,000.

As well as being directors of WRFC Trading Limited, Colin Goldring and Jason Whittingham are also directors of a number of other companies, including Mq Property Ltd.

On Wednesday, 17 August Mq Property Ltd completed the purchase of the freehold of the club's car park. This was paid for with a loan from another company, Triangle Estate & Petroleum Ltd.

Separately in June, training pitches owned and used by Warriors were sold to a newly-created real estate company, Worcester Capital Investments Ltd, for £350,000.

The car park and pitches are sizeable parts of the Sixways site.

Warriors' accounts for 2020 state that as a whole the site had been independently valued at £16.7m. That estimate includes Sixways stadium; the freehold of which also now belongs to Mq Property Ltd.

Unlike indebted WRFC Trading Ltd, Mq Property Ltd is not known to face a winding-up petition, yet it now owns the bulk of the land the club sits on.

It's unclear whether the £50,000 purchase of the car park was an undervaluation. Its value - and that of the training pitches - will depend on what restrictions are in place on the land, as well as how easy it is to develop.

Warriors' 2020 accounts describe how the planning potential for the Sixways site had been 'significantly improved'.

In recent months Goldring and Whittingham have also set up three other new companies, Sixways Medical Limited, Sixways Property Limited and Sixways Stadium Limited. They have not revealed the purpose of these firms.

Dodgy as fuck

-