Rugby Finances

-

@Crucial said in Rugby Finances:

How did Ireland build such big reserves?

I remember that NZ created a big pot some years ago with smart currency futures on sponsorship (or something similar). Ireland's one surely can't just be from operating profits.I think it's pretty obvious how!

-

@Crucial said in Rugby Finances:

How did Ireland build such big reserves?

I remember that NZ created a big pot some years ago with smart currency futures on sponsorship (or something similar). Ireland's one surely can't just be from operating profits.I put a "maybe?" for their one.

Its hard to read different types financial reports and know if its the same thing.

Ireland is here, if you want to look: https://www.irishrugby.ie/irfu/annual-report/BTW, the ARUs reporting is farking hard to find and read. No idea what their revenue is unless a media outlet reports it. No wonder they are farked .....

-

The majority of their money is stuck in loans (I guess to sub unions, they won't be getting that back in a hurry) and joint ventres. They have 38 million of cash (highlighted wrong year, sorry). The IRFU is doing bloody well for itself, a lot powered a Schmidts conquering ABs etc, they were on a high here!

-

@Machpants said in Rugby Finances:

The majority of their money is stuck in loans (I guess to sub unions, they won't be getting that back in a hurry) and joint ventres. They have 38 million of cash (highlighted wrong year, sorry). The IRFU is doing bloody well for itself, a lot powered a Schmidts conquering ABs etc, they were on a high here!

Iirc they had to bail out Munster and their Thomomd redevelopment debt. So, that is probably mostly in a loan to Munster.

Edit.

Actually only €6.86 million left (Original 2007 a loan of 11.5 million euro)

Here: https://www.the42.ie/thomond-park-naming-rights-munster-4736154-Jul2019/A loan from the national union helped the southern province to redevelop the Limerick stadium in 2007/08.

There have been struggles for Munster to repay that debt in recent years, although a €2.6 million payment in 2017/18 helped the province to reduce the total owed to its current €6.86 million.

The 2017/18 season also saw the province renegotiate its schedule of loan repayments with the IRFU, reducing their scheduled repayments down from €500,000 to €100,000 per year.

The new deal also means that the IRFU will receive 50% of Munster’s multi-year ticket sales, 50% multi-year corporate box sales, as well as 50% of any Thomond Park naming rights income on an annual basis.

-

Doesn't the IRFU have Aviva Stadium as an asset?

-

@antipodean said in Rugby Finances:

Doesn't the IRFU have Aviva Stadium as an asset?

Yes, but not 100% anymore like when it was Lansdowne Road. Own 57.5%

The Irish Rugby Football Union (IRFU) has dismissed reports that it could secure full control of Aviva Stadium amid the Football Association of Ireland’s (FAI) financial troubles, stating its investment plans are focused on the development of the sport.

The prospect of the IRFU taking over the FAI’s 42.5-per-cent stake in the Dublin venue emerged this week after the true extent of the latter body’s financial travails was revealed, including a request for an €18m ($19.7m) bailout from the Irish government.

Aviva Stadium is owned by New Stadium DAC, a company in which the IRFU holds a 57.5-per-cent interest alongside the FAI’s stake. Both organisations have two representatives each on the company’s board of directors.

The IRFU met yesterday (Thursday) with the Irish government’s Department of Transport, Tourism and Sport to discuss the operations of New Stadium DAC.

The union told the Irish Times newspaper: “To address recent speculation, the IRFU confirms that it does not have an interest in acquiring the FAI’s share in the Aviva Stadium.”

“The IRFU’s investment programme is centered firmly on the development of rugby at all levels and all available funds are fully committed to that programme.”

It is reported that the FAI and IRFU currently pay a licence fee of around €200,000 per month apiece to help cover the running costs of the stadium. However, the FAI is said to have fallen behind in its payments by the equivalent of six months, or €1.2m.

Irish public broadcaster RTE added that the FAI retains a debt of €29m on the stadium, with reports ahead of yesterday’s meeting stating that the IRFU could take over this debt in return for the FAI’s stake in the facility.

The 52,000-seat Aviva Stadium opened in May 2010, replacing Lansdowne Road as home of the Irish rugby union and football teams. Developed at a cost of €460m, the government’s contribution of €191m means it has the right to overrule any potential change in ownership.

The The total cost of building the Aviva was €411m, out of this, the Government injected 191m of the taxpayer’s money, and the remaining amount, €220m, is to be paid by the co-owners of the stadium, the IRFU and the FAI.

Aviva (New Stadium DAC) reported in this part here.

In accountancy speak, does that mean their 57.5% share is worth €163m, debt owing is €84m, so net asset is €79m

-

Not sure if this has been posted anywhere, but this seems a logical place.

https://www.nzherald.co.nz/sport/news/article.cfm?c_id=4&objectid=12330421

Sorry link doesn’t seem to be pasting properly...

-

Marquee player exemption to go?

Premiership Rugby clubs are moving towards removing marquee player signings from the salary cap in a desperate bid to reduce costs.

Even before the coronavirus pandemic, Exeter Chiefs were the only club to be turning a profit with player wages accounting for the vast majority of outgoings. The effect of the lockdown has magnified the financial crisis many clubs were facing, leading to a range of cost-cutting measures from salary reductions to staff being placed on furlough.

In the longer term, there is a widespread acceptance that the Premiership’s longer term financial model is broken. The current salary cap is set at £7million with two marquee players whose salaries are excluded from the limit. The marquee player rule was brought in to allow clubs to bring the best foreign talent to the Premiership, however one chief executive told Telegraph Sport that its main result has been to drive wage inflation across the rest of the squad....

-

Scotland update

(from The Times, mostly paywalled):

Hard on the heels of Scottish football’s appeal for government aid to survive the coronavirus crisis, the Scottish Rugby Union has signalled that it, too, could be looking for help as it faces what could become a massive hole in its finances over the coming months.

Mark Dodson, the union’s chief executive, suggested recently that the cancellation of this autumn’s three Murrayfield Tests would slash £12 million off the organisation’s income. If next year’s Six Nations matches are also affected then the shortfall would be closer to £30 million, or even more.

Dodson did not attend Tuesday’s Holyrood talks with Scottish government leaders and senior figures from other sports. His place was taken by Dominic McKay, the union’s chief operating officer, who stressed the value

Continue reading

-

South Africa, not as bad as some due to recent re-structuring of contracting model?

From The Rep, (not a media I've outlet of heard of before):

The loss of Super Rugby matches has obviously had an adverse reaction on the revenue, as well as match-day takings. Some of South Africa’s main rivals in New Zealand and England, have announced pay cuts for their players.

South Africa’s blushes have been saved by changing their Springbok contracting model last year. In June 2019 it was announced that SA Rugby would no longer directly contract its players and that all unions and franchises would have a cap on the number of professional players they could contract. It was part of a cost-cutting measure that is bearing fruit in these times of economic uncertainty.

What has also assisted SA Rugby as that all the Springboks contracted to overseas clubs like Handre Pollard, Willie Le Roux, Malcolm Marx, Eben Etzebeth, Cheslin Kolbe and many have salaries paid by their clubs, and that helps to alleviate the financial burden on SA Rugby.

For now, even the franchises are in a stable financial situation. The Bulls have the major financial backing of billionaires Johan Rupert and Patrice Motsepe. The Sharks and the Lions are stable, with huge financial partners. Even the Stormers, with their much-publicised financial struggles in recent times, are in a stable position.

-

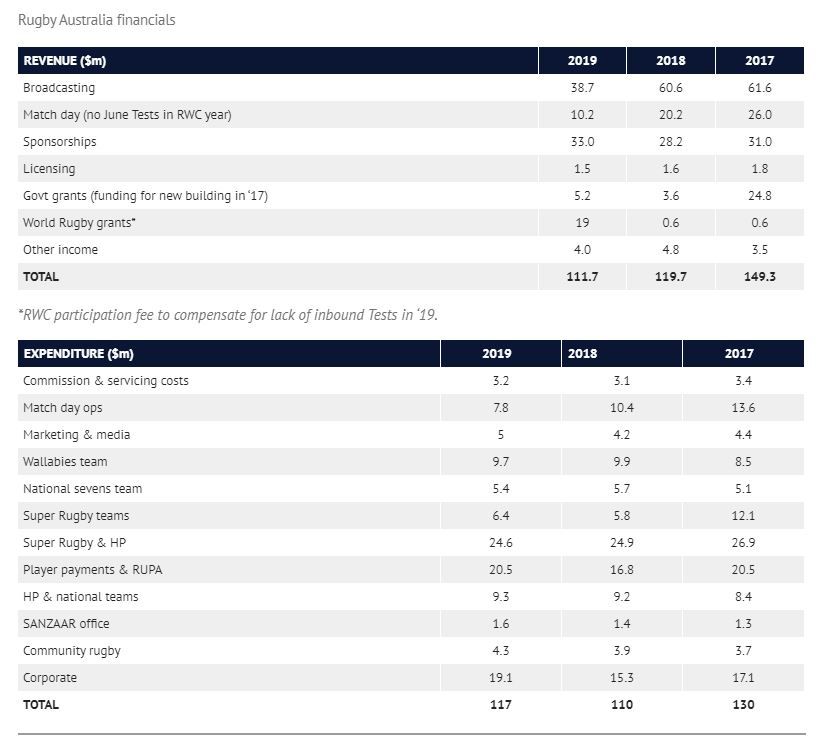

The real cost of the Israel Folau saga has been revealed by leaked Rugby Australia financial figures for 2019.

The figures, which were obtained by News Corp but were still to be signed off by auditors, show a A$4 million rise in "player costs and RUPA (Rugby Union Players Association)" and a A$3.8 million increase in "corporate costs".

According to the Sydney Morning Herald, the Folau settlement – estimated to be around $4 million – is included in the player costs, with half paid by NSW Rugby. Cost of the payout is also included in the $20 million Rugby Australia owes to creditors.

The other reasons for the spike in player costs include payments for the first year of Wallabies captain Michael Hooper's contract and a deal to bring halfback Nic White back to Australia in the middle of 2020 after his stint in England.

https://www.nzherald.co.nz/sport/news/article.cfm?c_id=4&objectid=12331395

-

Exclusive: All Blacks turn their backs on autumn internationals

The All Blacks are set to abandon their three-match British tour this autumn, a decision which will cost England, Wales and Scotland more than £20m.

Their move towards cancelling Tests scheduled for Cardiff, Twickenham and Murrayfield on successive Saturdays in November is based on advice from the New Zealand government. It follows a warning from Prime Minister Jacinda Ardern that their borders will ‘remain closed to the rest of the world for a long time’.

The Rugby Paper understands that the New Zealand Rugby Board are preparing to sacrifice their UK fixtures rather than risk jeopardising the country’s success in virtually eliminating the Covid-19 pandemic from their shores. It will tear yet another gaping hole in the sport’s dissolving finances.

The news comes hot on the heels of RFU chief executive Bill Sweeney’s claim that the prolonged effect of lockdown threatens to cost the world’s richest Union £107m within the next 12 months. His Welsh counterpart, Martyn Phillips, estimates Wales stand to lose around £50m.

England-New Zealand is being promoted at Twickenham as ‘one of the most anticipated matches in rugby’, all the more so since England smashed the All Blacks’ World Cup monopoly in Yokohama. In addition to £10m plus guaranteed in ticket sales of 82,000, the RFU stand to lose another fortune from other commercial spin-offs.

The Official Twickenham Hospitality website shows that tables of ten for the match have been sold out, at £14,490 per table. Various agencies are advertising single tickets at up to £799.

Instead of touring, New Zealand plan to launch a series of matches involving their Super Rugnby franchises followed by a four-Test series against Australia, all behind closed doors. The respective governments took a major step last week towards making it possible by creating a trans- Ta$man ‘bubble’, allowing free movement without any quarantine requirements.

Can't say I'm looking forward to a 4 match series, behind closed doors.

Gotta do what they gotta do, I suppose. -

No surprise to me. If the NH nations aren't coming south in July (or later in the year) there is no reason to go north in November.

Not enthused about 4 tests against Aust either. I assume that would be 2 at home and 2 away. No need to play the home games at Eden Park though.

IRFU has no interest in FAI’s Aviva Stadium stake

IRFU has no interest in FAI’s Aviva Stadium stake

Rugby feels the pinch of no play in the back pocket - The Rep

Rugby feels the pinch of no play in the back pocket - The Rep