Rugby Finances

-

Westpac Stadiums most recent financial report.

https://www.westpacstadium.co.nz/fileadmin/images/content/WRST_AR18.pdf

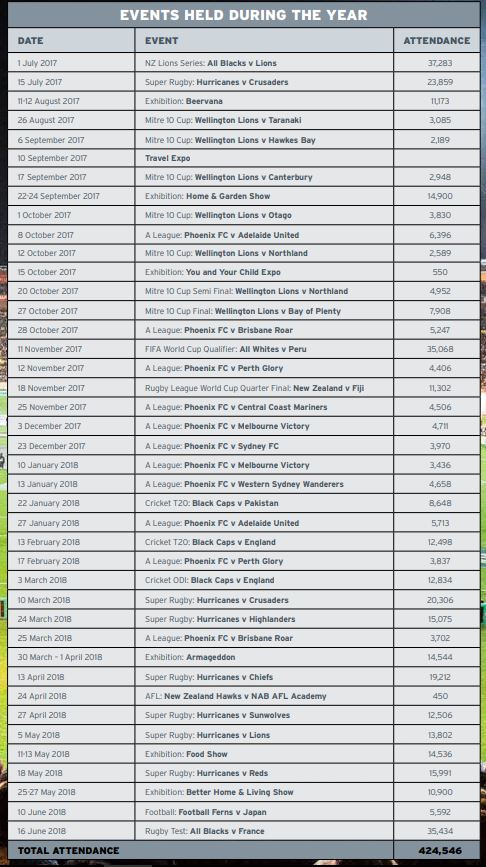

Westpac Stadium hosted a total of 50 major event days for the year, plus

several community event days. Over 424,000 fans attended events during the

12 months, with the cumulative attendance since opening now at 9.73 million.

To keep it rugby related. Rugby attendance was 51% (217,243 out of the 424,546). Which was an exceptional year with 2 All Back tests falling within the FY.

-

still on the caketin report.

FINANCIAL PERFORMANCE

Our net surplus for the year was $1.3 million compared to $1.7 million in 2017.

Event revenues were $7.8 million compared to $6.9 million in the previous

year and a budget of $6.9 million.

Our budgeted surplus for the year was $2.6 million, which included grant

income from the Wellington City Council of $1.75 million. This is part of a $5

million contribution toward the concourse upgrade currently underway, which

is payable as work progresses. The amount received in the June 18 financial

year was $0.33 million. The balance will be received in future years. Excluding

this grant income, the net surplus was $0.94m, slightly ahead of the budget

of $0.85 million.

Both the Caketin and Forsythh Barr I would classify as succesful stadium builds that have come in at a level that debt burden is manageable (In Caketin's case has been getting repaid at a good level).

Caketin: The Stadium cost $130 million to build. The finance came from:

Wellington Regional Council: 25$M

Wellington City Council: 15$M

Grants and Donations: 7$M

Fundraising: 50$M

Bank Loan: 33$MThe bank loan is now just $2.5m

I just can't believe the Christchurch stadium plan. I won't recommend the Caketin model, I'd say aim a bit higher with a covered rectangular stadium. Why any council isn't trying to copy Dunedin as close as possible (without the bitter politics ...) is beyond me.

-

The Christchurch plan, options.

I recommend clicking the link above.

from the article:

-

Option 1 is a stadium with covered seats only, estimated to cost about $385m

-

Option 2 is a stadium with a transparent ETFE plastic roof similar to that at Dunedin's Forsyth Barr stadium, estimated to cost about $470m

-

Option 3 is a stadium with a solid roof, concrete floor and retractable turf (so grass could grow outside), estimated to cost about $561m.

Forsyth Barr cost $224.4m

I say chose option 2.

-

-

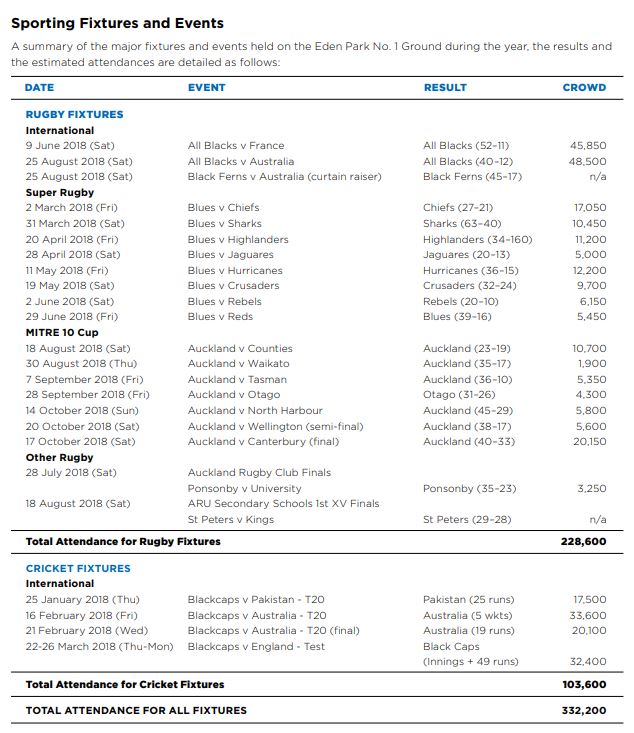

Eden Park's most recent report (a year ahead of the Caketin's above).

https://www.edenpark.co.nz/uploads/images/Eden Park Annual Report 2018.pdf

Big concern here is (2018):

- Sports Events Income 5,804,000

- Sports Events Expenses 7,733,000

An even in 2017 (Lion year), just a small sports event profit:

- Sports Events Income 8,646, 000

- Sports Events Expenses 7,509,000

Need to increase those paltry Blues and Auckland NPC crowds.

-

From the FT.

I'd guess Wasps will get a fine.

Wasps rugby club faces FCA probe over market statements

Formal investigation into Premiership team’s overstated earnings

Caroline Binham in London 9 MINUTES AGO

Rugby club Wasps is being investigated by the UK’s financial regulator over whether it misled the market about the state of its finances and how quickly it rectified the matter.The Financial Conduct Authority’s scrutiny comes after the 152-year old Premiership club admitted to creditors in late 2017 that it had overstated its earnings, breaching covenants on a £35m retail bond, and its auditors, PwC, stepped down after finding “falsified” information.

A £1.1m capital injection by Derek Richardson, the Irish businessman who owns Wasps and is its chairman, was wrongly stated as income. According to a market announcement made in December 2017, this cut the club’s earnings to £2.4m rather than the £3.5m it first stated.

Proceeds of Wasps’ bond, which is traded on the London Stock Exchange, go partly towards developing the club’s Ricoh stadium in Coventry and refinancing debts. The accuracy and timeliness of statements to the markets made by Wasps’ special purpose vehicle, the issuer of the bonds, are overseen by the FCA.

The watchdog has opened a formal investigation and is summoning individuals for interviews, said people familiar with the situation. The FCA has the power to fine and criminally prosecute breaches of its market-cleanliness rules.

-

Quite a fascinating back story to how Wasps ended up with the opportunity of owning the Ricoh Arena.

I didn't know that the Coventry City owners had plumbed such depths of shithousery, I just assumed they were a typical yo-yo club that had over-extended themselves into financial ruin.

Heartwarming story of a Hedge Fund attempting to pay hard ball but fucking up big time.

-

Coventry City, even though in the third tier these days - still average 10-12,000 over 22 home league games, plus cup ties.

Wasps wouldn't be wanting to lose a tenant like that.

Although they wouldn't mind losing a tenant that is constantly sueing them .....However, Coventry City also don't want to be risking getting thrown out of the Football League for being homeless.

https://www.bbc.com/sport/football/43979047

Now that Coventry City owners have lost their court battle, Wasps say they are open to talks

https://www.bbc.com/sport/football/47951057

Wasps have opened the door to the idea of talking again to the Sky Blues.

The rugby club, City's landlords, have always said they would be ready to discuss a new deal once the legal action ended.

-

Wales and Scotland made to wait in World Cup player release row

• Premiership and World Rugby could agree deal next month

• Dispute centres around insurance for non-English players

Gerard Meagher

Thu 25 Apr 2019 19.48 BST Last modified on Thu 25 Apr 2019 23.07 BST

Wales and Scotland are among a number of nations who will not find out until next month if their World Cup preparations will be severely disrupted by being denied early access to their Premiership-based players.

Warren Gatland names Wales’s World Cup training squad next Tuesday but the Guardian understands it will not be clear whether players such as Liam Williams, Dan Biggar and Taulupe Faletau are available for their altitude training camp in July, and their first warm-up match against England on 11 August, until World Rugby’s council meeting on 22 May.

As revealed by the Guardian last December, Premiership Rugby (PRL) issued World Rugby with a threat of legal action over an insurance row and had vowed to strictly enforce regulations over the release of non-English players in the top flight as a result.

That would mean Williams, Biggar and Faletau as well as a raft of Scotland internationals in the Premiership cannot join their countries’ World Cup preparations until mid‑August, only 35 days before the tournament begins in Japan. Tonga, Samoa and Fiji would also have their preparations hampered.

The Guardian understands that PRL and World Rugby are close to an agreement and that a proposal is due for consideration at the global governing body’s council meeting next month.

But while there is a degree of confidence from both parties it will be signed off, there is still some way to go before the agreement is finalised.

“We are continuing to have discussions with World Rugby and while we have made progress there are still some outstanding issues,” a PRL spokesperson told the Guardian. “Positive discussions are ongoing, however there are still some details that need confirming. We cannot confirm these finer details at this stage but we look forward to further positive discussions with World Rugby.”

The Breakdown: sign up and get our weekly rugby union email.

The initial dispute centred on World Rugby’s regulation 23, which states clubs are compensated by unions for injuries picked up on international duty for players who earn £225,000 or less a year. Anything more than that is paid by the clubs.

World Rugby had agreed to increase the threshold to £350,000 but PRL wanted no limit and requested it be removed on the basis there are 60 non-English internationals in the Premiership earning £225,000 or above and 25 on £350,000 or above. That was rejected last year, as was another request to do away with the 12-month limit, which means clubs are liable for any injury longer than a year.

The impasse – which led to that threat of legal action last December – prompted PRL to take a stance that no non-English Premiership players would be available for selection by their countries until the official pre‑World Cup window opens. According to World Rugby’s regulation 9, PRL must release players when it does open but does not have to before. If World Rugby ratifies the new proposal next month, however, those players are set to become available to their countries much earlier.

-

Not a lot more new info. But contains a nice tidy table of wages as a % of turnover.

Plus Exeter chairman explaining how their balance sheets are now magically healthy after CVC valued their league at 800 million, and can they can now borrow even more based on said healthy balance sheets.

-

google translated, so may read a bit rough.

from Rugby365

TOP 14 - STADE FRANÇAIS: A RECORD DEFICIT FOR THE PARIS CLUB?

POSTED ON APRIL 16, 2019 AT 9:48 PM THIBAULT LAURENS

For the second year in a row, the Stade Français will experience a budget deficit. After the 18 million euros of losses last year, they would amount to 17 million euros this season. That's 35 million since the arrival of Hans-Peter Wild which is a sad record.>

From Le Monde:

Hans-Peter Wild wants results. For the moment, the owner of the Stade Francais must rather be content with an unfortunate record. According to information from the World , confirmed by the "stadist" direction, the Parisian rugby club recorded an operating deficit unprecedented in the history of the championship of France: a loss of 18 million euros to the resulting from the 2017-2018 season, the first with the billionaire as new shareholder. That is more than half of its annual budget, estimated at around 32 million euros.

A trifle for Hans-Peter Wild, 77 years old. Born in Germany, living in Switzerland, the billionaire spends countless. The man can afford little juicy balance in rugby: he made his fortune in the fruit drinks industry.

In June 2018, according to a document procured by Le Monde, the septuagenarian has already considerably bailed out the coffers. On the occasion of an extraordinary general meeting, the "doctor" Wild (his university title) injected 19 million euros into the share capital of Stade Français Paris - an amount still greater than the deficit. Accounting to excess of his personal resources, and a professional rugby that involves more and more investors as expenses. Quit playing with the balance of clubs, even with their durability ...

The National Directorate for Management Assistance and Control (DNACG) will comment in more detail on the loss in question. This independent body is scheduled to close in March its next annual report on the financial health of French Ovalie. In May 2018, the latest publication concerned the 2016-2017 season: the accumulated deficits of eight Top 14 formations amounted to 27.5 million euros.

-

NZRU released their annual report about 2 weeks ago. Seen nothing in the media.

From the Finances POV - This year made a $1.8 million loss. The previous year (a Lions year) made a $33 million profit.

Trucking along, nothing too extraordinary

http://files.allblacks.com/publications/2018-NZR-Annual-Report.pdf

-

@Rapido There were articles in the herald and stuff about it e.g.

https://www.nzherald.co.nz/sport/news/article.cfm?c_id=4&objectid=12223217

It's the future they are worried about, a lot of the money comes from playing the currency, which is not, or may not be available(paid in US$ or whatever) - we need that big WR deal TBH

-

CVC and the 6 Nations.

http://www.sportspromedia.com/news/six-nations-rugby-cvc-minority-stake-sale-investment

Six Nations in exclusive talks with CVC over £300m minority stake

The Six Nations has entered into an exclusive period of negotiation with CVC Capital to sell a stake in the rugby union Test competition, it has been confirmed.

It had been reported in July that the Six Nations was in talks with the private equity firm to give up a minority share for UK£500 million (US$621 million) in order to provide a financial boost for each union competing in the championship and help grow the game.

Initially, the deal was believed to be for an approximate 30 per cent share in the Six Nations. But with the sale now moving a step closer, it appears CVC is set to take control of 15 per cent of the competition’s commercial arm for £300 million (US$372 million), according to the Times.

If the deal goes through, it’ll mean the company will also own a share of autumn internationals and summer tours after European rugby unions decided to pool their business into one commercial entity.

The sale is apparently set to be completed after the Rugby World Cup ends on 2nd November.

A Six Nations statement said: ‘Six Nations believes that investment in rugby football is vital for the long-term future of our game and this belief is central in our decision to enter into this period of negotiation.

‘Six Nations, together with its constituent unions and federations, has agreed to enter into an exclusive period of negotiation with an external investor partner.

‘As these negotiations are confidential and commercially sensitive, Six Nations will not be making any further comment.’

From an SH interest POV, not sure what they mean by this part' "If the deal goes through, it’ll mean the company will also own a share of autumn internationals and summer tours after European rugby unions decided to pool their business into one commercial entity."

Is it a lack of knowledge of revenue model by the financial authors? Or is something afloat. Can't be meaning the BILs , although wouldn't be surprised if they were interested in that.

-

RWC 2019 has officially become the highest grossing Rugby World Cup. Three days out from the start of the competition the tournament has already surpassed all others.

Japan bid for RWC 2011 only to lose to New Zealand. At the time of the decision, in 2005, it was voted against to favor the established order. Japan would win for RWC 2019 against Italy and South Africa though there was still plenty of doubt about hosting the RWC away from the traditional bases of the UK, France, Australia, New Zealand or South Africa.

Approximately 400,000 tourists are expected in Japan for RWC 2019. Thus far over 97% of the tickets have been sold. The revenue from this equates to 245million Stirling which is 15million more than that from RWC 2015 in England and Wales.

-

https://www.spglobal.com/marketintelligence/en/news-insights/podcasts/street-talk-episode-56

European private equity companies have asked some companies in their portfolios to draw down credit facilities on fears of a potential liquidity crunch amid the coronavirus outbreak, Bloomberg News reported March 14, citing people with knowledge of the matter.

EQT AB (publ) and Permira Advisers Ltd. are among private equity firms taking such measures, with CVC Capital Partners Ltd. also discussing the potential of tapping into unused credit lines for some companies in the future, the people said. Representatives for the firms declined to comment to Bloomberg.

The investment firms are especially concentrating on companies in consumer-oriented industries most likely to be hit by impacts from the virus, according to Bloomberg.

The European firms join the likes of The Blackstone Group Inc. and Carlyle Group Inc. in recommending the preparatory measures to avoid being strapped for working capital if the economic situation aggravates.

But also, another perspective.

The virtue of private capital is that it can withstand short-term volatility in valuations of assets held for the long term – and now is the time to prove that.

-

Catching up on this, a lot of crossover now with the Covid and Sport thread .....

From 2 weeks ago.

Probably a lucky break for CVC on this one ...

A proposed £300m deal by CVC Capital Partners to invest in the Six Nations, Europe’s leading rugby union tournament, has been delayed as the sport reels from a financial crisis resulting from the coronavirus pandemic.

The Luxembourg-based buyout group has plans to become the biggest commercial player in one of the world’s favourite sports, lining up a series of investments to reshape the global game.

But CVC’s biggest proposed deal — a £300m transaction for a roughly 14 per cent stake in the Six Nations, one of the rugby’s flagship tournaments, expected to have been signed a month ago — has been held up.

The unions involved — England, Scotland, Wales, Ireland, France and Italy — are reluctant to press forward with fixtures postponed and a lack of clarity about the financial hit they face from the resulting lack of income from broadcasting and ticketing.

The Six Nations said: “We have not agreed to either take a break nor to push through a completed agreement. The conversations are simply ongoing and obviously take into account the new environment created by the current pandemic.” CVC declined to comment.

People briefed on the conversations said they believed the deal could still be completed this year, with CVC executives committed to an investment thesis around incresing the value of broadcasting and sponsorship contracts in rugby. It is not clear whether the deal’s terms will be the same as initially proposed, the people said.

“Everyone's just saying let's draw breath, make sure whatever we're doing we're getting it right,” said a person with knowledge of the talks.

The buyout group has made ambitious plans to invest more than £600m in the game, initiating talks with other important organisations, including South Africa and New Zealand, two of the biggest southern hemisphere rugby nations, as well as with World Rugby, the international governing body.

Wasps rugby club faces FCA probe over market statements

Wasps rugby club faces FCA probe over market statements