Silver Lake buying a stake in the ABs?

-

OPINION:

The vexed issue of Silver Lake will be back on the table this week and while New Zealand Rugby remains adamant that a deal with the US private equity group is imperative for the game to grow, the national body has, in the last few months, almost eliminated their own rationale for striking an alliance.

Back in February when news became public that Silver Lake wanted to buy a stake in NZR's future revenue for $387m, there was such uncertainty about likely income and the relative strength of the game's finances that the basis to entertain the proposal was undeniably strong.

NZR was bleeding cash in a pandemic-impacted world and couldn't be sure when or if it would ever stop – and for how much longer they could keep dipping into their cash reserves, however seemingly deep they appeared.

Somewhat curiously, NZR also campaigned to sign with Silver Lake on a vote of no confidence in themselves. The argument to bring in Silver Lake was two-fold – the business needed money, but just as importantly said NZR, it needed expertise.

NZR said they had looked at all sorts of ways to raise capital, but dismissed those which didn't bring with it access to capability – suggesting that if the business was flooded with cash, they wouldn't have the contacts, strategic vision or financial wherewithal to effectively use it.

The argument keeps being made that the key to sustainable growth is growing the presence and value of the All Blacks brand in offshore markets and therefore it would be best to hand this responsibility to international figures with contacts and knowledge of how things work in far-off places.

Stay ahead of the gameFor the NZR executive and board to paint themselves as incapable of delivering in the cut and thrust of global commerce was always a risk - because while it was intended to vindicate their support for a deal with Silver Lake, it made many wonder whether the better course of action would be to simply repopulate the executive and board with people who are.

The argument that NZR needs the acumen brought by Silver Lake has always been the harder one to swallow, but now it has no chance of slipping down the gullet of even staunch advocates of private equity investment.

In the last few months, NZR has proven unequivocally it is neither impoverished nor bereft of commercial expertise having secured in excess of $50m a year in sponsorship for real estate on the All Blacks kit.

NZR's commercial team have delivered a four-fold increase on the current deal with AIG which is estimated to be worth about $12m a year.

It was a process that attracted the biggest corporate names in the world, including Amazon, and has rubbished any notion of NZR needing to be in bed with Silver Lake to gain access to those with the deepest pockets.

NZR worked with a marketing firm to land these new deals, which only accentuates the arguments those against Silver Lake have been making, which is that it makes more business sense to pay one-off consultancy fees to recognised experts than it does to sell 12.5 per cent of revenue in perpetuity to Silver Lake.

What it's also done is throw into question what specifically Silver Lake can bring to the table that is not already there.

NZR has locked into six-year deals with new kit sponsors Altrad and Ineos, and has another four years left to run on their broadcast contract – a deal that is looking increasingly like a stroke of genius given the dramas Rugby Australia has incurred by spurning the advances of their long-term partner.

NZR has also organised two additional tests this year for cash payments of about $5m and so it is not clear at all which existing revenue stream it is that Silver Lake feel they can greatly improve.

And if they do have a plan, it will need to be hugely compelling – stack as low-risk and enormously lucrative – as if they come on board under the proposed terms, they will automatically net a share in the existing sponsorship and broadcast deals.

NZR has done all the hard work bringing those deals to fruition, yet if they sell to Silver Lake, the US firm will be entitled to 12.5 per cent of that revenue – an estimated $17m a year.

NZR, through their well-executed commercial sponsorship and broadcast strategies, have killed their own argument that a deal with Silver Lake is imperative and when talks re-ignite with the New Zealand Rugby Players' Association this week, they will need a new basis on which to sell the merits of a private equity deal.

-

This seems to be the key to it:

NZR had to find new ways of sourcing captial. Under the leadership of Steve Tew they started investigating private equity but couldn’t get anything to stick. Then investment bank Jefferies, whose head of global equity sales Matt Foulds was Robinson’s Cambridge rugby captain, came on board and suggested putting all their assets on the table.

NZR was selling the concept as a win-win. The NZRPA saw a sugar hit that could turn into a win-loss as they raised a number of questions around sovereignty, the inherent financial risks associated with private equity, the potential for competing interests and what they saw as a lack of due diligence over alternative capital sources.

(NZR denies this, saying Jefferies “exhaustively” looked at all options).

Reminds me of the "Tim nice but dim" sketches from the Harry Enfield Show.

-

-

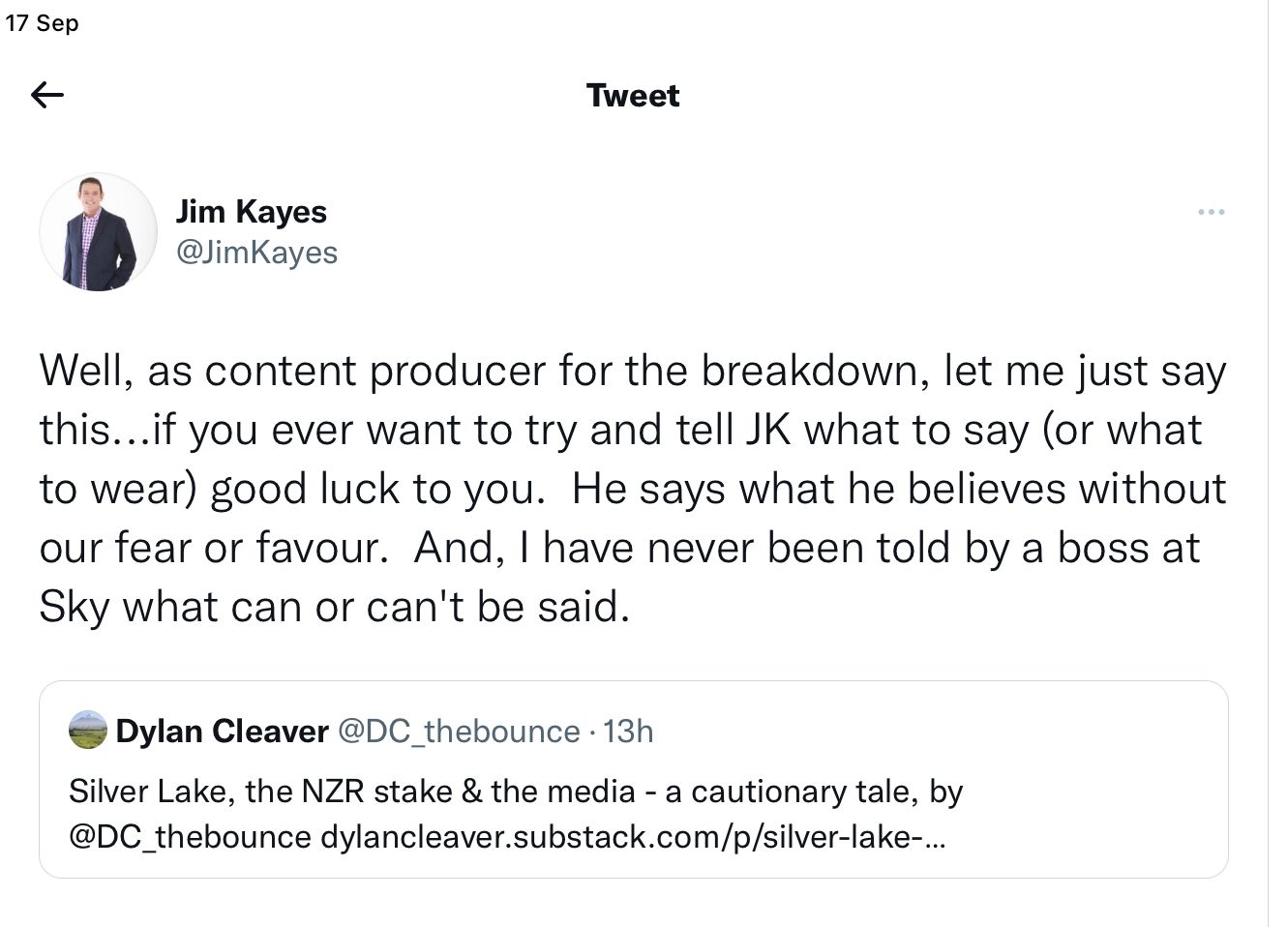

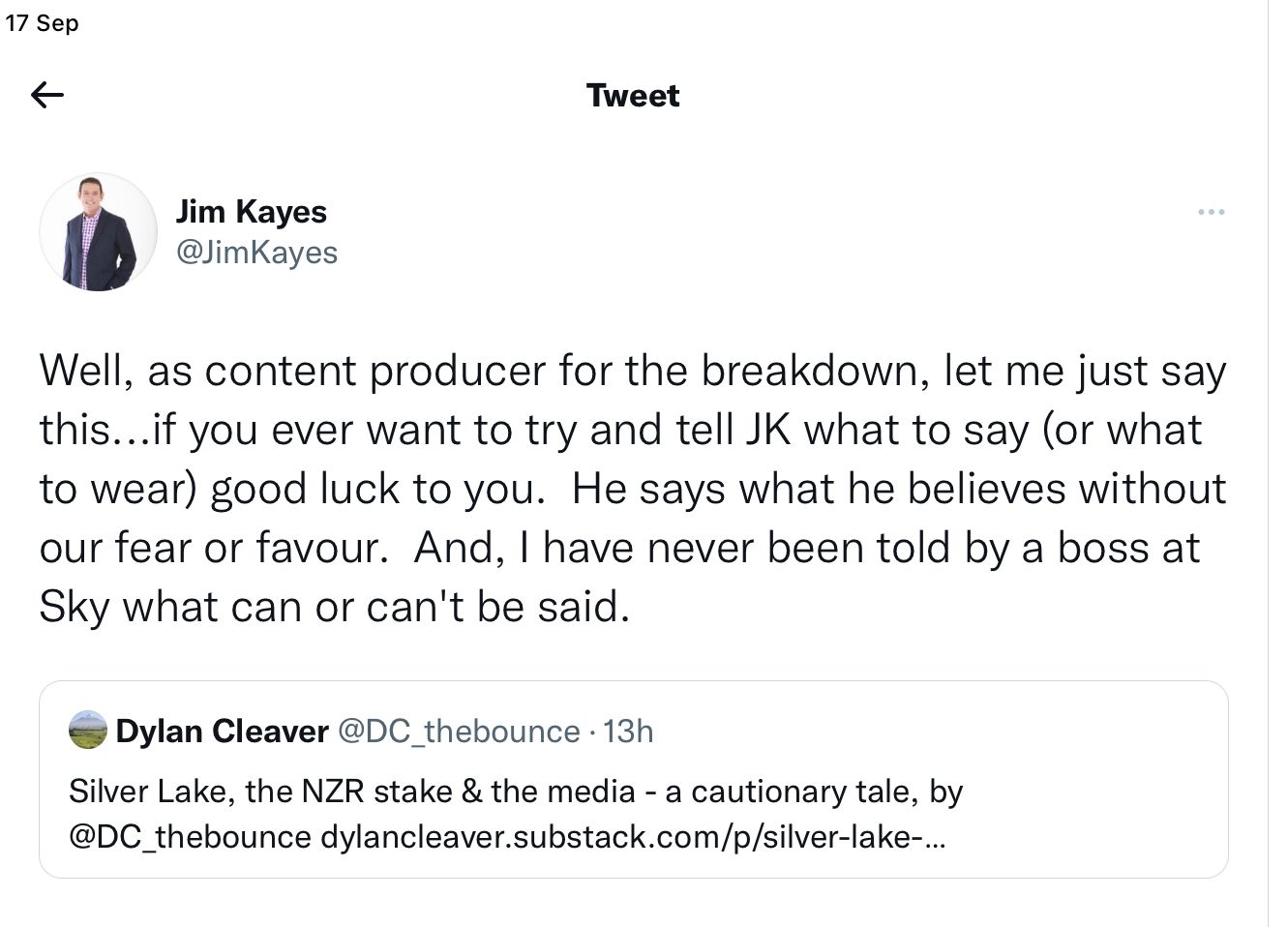

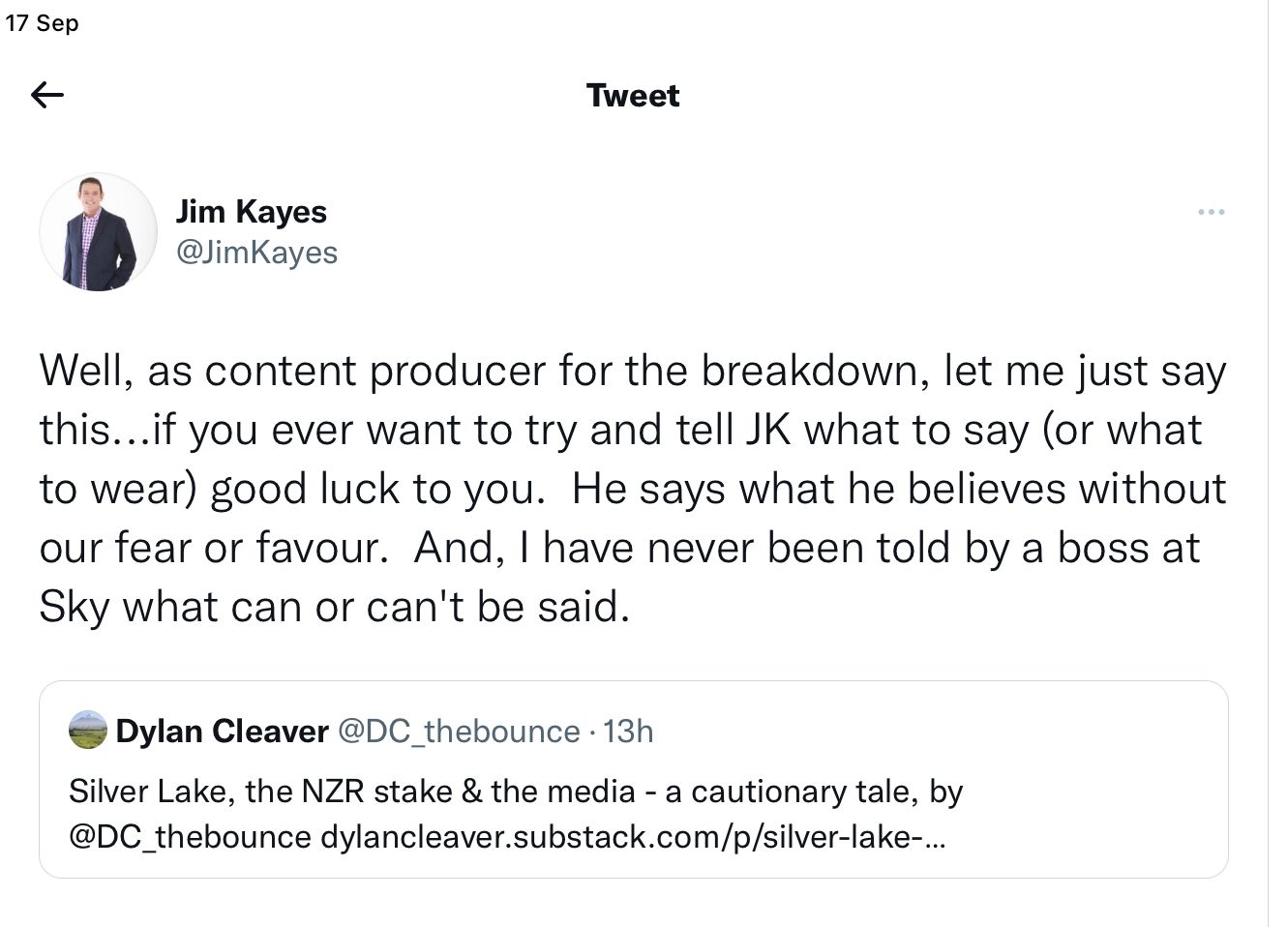

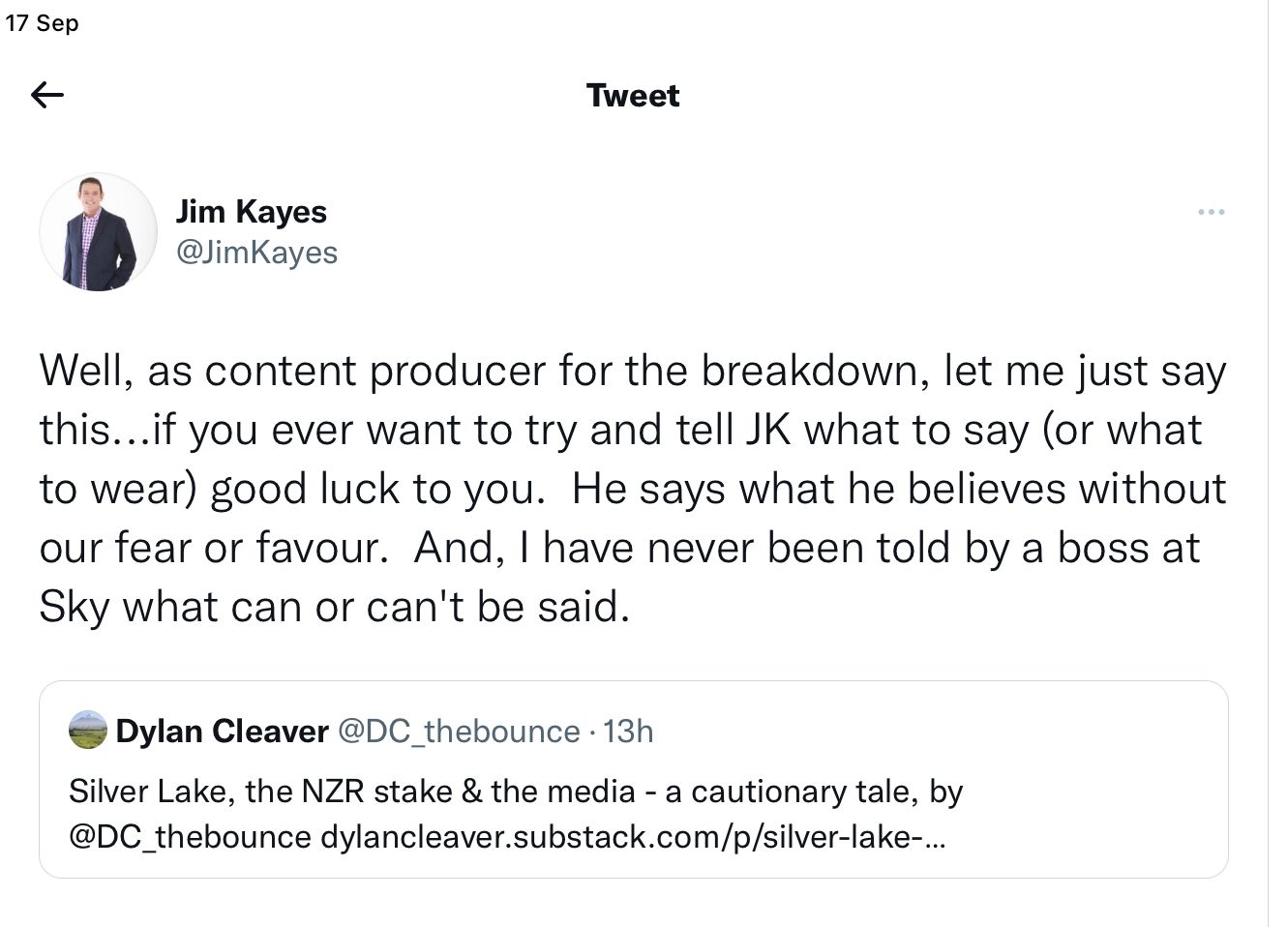

@steven-harris said in Silver Lake buying a stake in the ABs?:

Hardly going to take being called the media arm of the Kremlin lying down, but isn't that what the media arm of the Kremlin would say?

-

The Herald on Sunday understands Silver Lake's improved valuation for a 7.5 per cent stake was tabled after the Players' Association officially outlined its intent to not support the 12.5 per cent sale proposal three weeks ago, sparking rumours the deal was dead.

While extracting a higher valuation for a lower sale stake lessens the risks and retains more revenue, reducing the capital injection has the potential to leave the New Zealand game exposed in a fraught Covid-affected climate.

After receiving Silver Lake's improved offer, however, the Players' Association is understood to have responded with a set of conditions to ensure what they believe is a "genuine partnership".

Those conditions include the request for an independent NZ Rugby governance review that assesses the constitution, striking at the heart of the provincial union's control, and whether the existing structure is fit for purpose.

This request comes after attacks on the players by former NZ Rugby chairman Brent Impey, the breakdown of the relationship with Australia and with a view to being fully equipped to work alongside heavyweight global businessess

-

A bit of news from one of Dylan Cleavers free emails I get.

Public ownership is back on the table: How the Silver Lake deal has taken a dramatic turn

American private equity giants Silver Lake remain committed to taking a stake in New Zealand Rugby, but the deal that emerges could be unrecognisable to that originally proposed - including the potential for a bond issue instead of equity, and public ownership of the All Blacks.

While the deal has stretched into one of the country’s most prolonged (and important) sporting sagas, The Bounce has learned that talks have taken a radical twist in the past month, particularly since the Players’ Association (NZRPA) and Silver Lake have started talking directly.

While the framework of the negotiations remains sensitive, it is understood that rather than have New Zealand Rugby relay the concerns of the NZRPA to Silver Lake, the latter two parties have actively engaged each other to find a way through what was threatening to become an impasse.

These talks are believed to have raised two distinct and intriguing possibilities.

Rather than buy a stake in New Zealand Rugby (via a subsidiary company that would handle all of NZR’s commercial arrangements), they could invest capital valued at five percent of the company through a bond issue, which could mature into equity if certain targets are met.

The other notable conversation is the potential for a public share offering of up to five percent of NZR’s valuation.

This idea was originally nixed by NZR but Silver Lake are thought to be attracted by the idea as it would give them an obvious exit strategy if needed and, also, it increases the branding and marketing potential of the All Blacks as the “people’s team”.

Silver Lake have never made their position public on any potential deal and a source familiar with the thinking of both NZR and NZRPA said there was still a lot to happen before anything was put in front of the board for signoff.

What it does call into question, however, is the merits of the original deal passed at this year’s AGM, which would have seen Silver Lake take a 12.5 percent stake in New Zealand Rugby based on a $3.1 billion valuation - a valuation that is understood to have increased significantly within the terms of the latest proposals.

At the time, the equity stake was sold to the 26 provincial unions and Maori Rugby (and the public) as not only the best, but the only, option.

According to sources, many of rugby’s auxiliary stakeholders, including talent management firms and broadcasters, are increasingly keen on a reshaped Silver Lake deal, believing PE could give the sport here a timely boost.

The negotiations are reaching the pointy end at a time when the world is seemingly awash with money that is looking for a home in sports, with PE firms believing the entire sector is under-capitalised and lacking the sort of capability they can offer.

This week, CVC Capital Partners made another enormous splash in the Sportotainment world. The Luxembourg-based private equity company, who once owned Formula One and are now heavily invested in European rugby and more recently Spanish football’s premier football competition La Liga - although glamour clubs Barcelona and real Madrid opposed the deal and opted out - took a stake in one of two Indian Premier League franchises available.

CVC bid US$692 million (just shy of NZ$1 billion) to place a franchise in Ahmedabad, home to the newly renovated Narendra Modi Stadium, which at 132,000 capacity, is the largest cricket stadium in the world. A second franchise, to be based in Lucknow, went for a whopping US$932 million.

Neither Silver Lake nor CVC started with the intention of using sport as big investment vehicles - Silver Lake started in the midst of the dotcom boom and tech was its focus - but it is a measure of how much growth they see available in the sector that they continue to invest with eye-popping numbers.

It’s also why Silver Lake is not going anywhere. A deal will be done

-

@kirwan said in Silver Lake buying a stake in the ABs?:

@steven-harris said in Silver Lake buying a stake in the ABs?:

Hardly going to take being called the media arm of the Kremlin lying down, but isn't that what the media arm of the Kremlin would say?

They hardly need to be told what / what not to say, though? They can just look at a guy like Mexted, or anyone else who has been critical, and connect the dots.

-

@junior said in Silver Lake buying a stake in the ABs?:

@kirwan said in Silver Lake buying a stake in the ABs?:

@steven-harris said in Silver Lake buying a stake in the ABs?:

Hardly going to take being called the media arm of the Kremlin lying down, but isn't that what the media arm of the Kremlin would say?

They hardly need to be told what / what not to say, though? They can just look at a guy like Mexted, or anyone else who has been critical, and connect the dots.

Exactly. And their coverage was poorer for it.

-

@bovidae This goes to show how gullible our administrators are. NZR have sold them a turkey. As the Gregor Paul article says, Silver Lake offered no particular expertise. That said, then this just becomes a finance deal in return for ownership. That is always the most expensive form of finance. If they believe they can grow the revenue base then borrow the money. Everyone thinks they can transfer risk with contracts. Public Private Partnership anyone? Always end up in a clusterfuck unless one party is dumb enough to get screwed…NZR.

Mark Robinson (MBA Graduate I presume) just never comes across well and along with Impey their behaviour in this episode has been appalling. Trying to railroad the proposal, and dismissing opposition with derogatory remarks. This is a public asset with multiple stakeholders. Stop behaving like assholes.

-

The Herald was leaked a report which showed that had NZR taken that deal with Silver Lake as it stood in April, they would most likely be running at an operating loss by 2025 and living off the investment returns of their cash reserves.

It was a deal that screamed short-term fix, which was underlined when the greatest advocates of short-termism, the provincial unions, voted unanimously to jump into bed with Silver Lake and cuddle up one hand each on the family silver between them.

The unions were promised a windfall when the deal went through and – with their pokies money drying up, sponsorships shrinking and crowds dwindling – of course they said yes to Silver Lake's cash, deaf to the dissenting voice of the Rugby Players' Association (RPA) which was asking pertinent questions about the longer-term implications of a deal that had no performance measures nor a defined exit strategy and no detail on how the US firm was going to double the revenue as it was forecasting.

Former NZR chairman Brent Impey famously said the professional players would be scoring an own goal if they didn't support the transaction, saying the $3.1bn valuation placed on the business was unprecedented in the field of private equity investment in sport and an unbeatable deal.

It appeared to be all part of a narrative pushed by NZR to paint the RPA as greedy and self-interested in blocking the original deal, because that's what happens in the post Trump-era – those who perceive they hold absolute power rely on a suite of tricks such as pejorative and bombastic statements and accentuating the fear of missing out to wield it.

Four months on and Silver Lake, who have since July been communicating directly with the RPA, have radically reshaped the deal from a smash-and-grab raid to one that could potentially have significant long-term benefits. They have upped their evaluation – believed now to be $3.6bn – are willing to take just a 7.5 per cent stake, with a timeline and mechanism to trigger their exit having been discussed.

The greatest own goal in the history of sport would in fact have been agreeing to the supposed deal of a lifetime that NZR were pushing back in April.

Short-termism is such a powerful movement, however, that the provincial union chairs were in Wellington this week, pitchforks in hand and burning effigies of RPA boss Rob Nichol, demanding to know from the NZR where their Silver Lake deal (cash) is.

The questions they should be asking are why this new, better deal wasn't on the table back in April and what sort of advice are NZR receiving from their investment bank advisers, Jefferies, who, it is believed, stand to make $6m if agreement is reached with Silver Lake.

-

The Herald was leaked a report which showed that had NZR taken that deal with Silver Lake as it stood in April, they would most likely be running at an operating loss by 2025 and living off the investment returns of their cash reserves.

Who wrote the report and what was their agenda?

-

@booboo said in Silver Lake buying a stake in the ABs?:

The Herald was leaked a report which showed that had NZR taken that deal with Silver Lake as it stood in April, they would most likely be running at an operating loss by 2025 and living off the investment returns of their cash reserves.

Who wrote the report and what was their agenda?

I don't want people thinking I'm supportive of the Silver Lake deal, but was that report written by someone that does covid-19 or treasury modelling..?